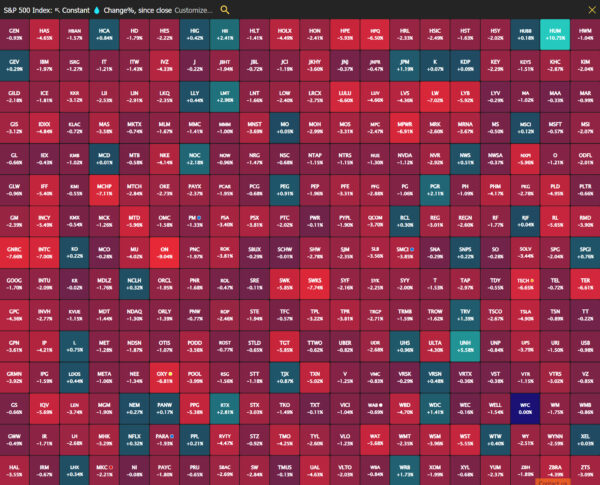

Dow -320.01 at 37645.59, Nasdaq -335.35 at 15267.92, S&P -79.48 at 4982.77

Dow Jones Industrial Average: -11.5% YTD

S&P 500: -15.3% YTD

S&P Midcap 400: -17.9% YTD

Nasdaq Composite: -20.9% YTD

Russell 2000: -21.1% YTD

Another volatile day on Wall Street pushed the S&P 500 Index back to the brink of a bear market as the Trump administration doubled down on its plans to enact hefty tariffs that threaten to send the American economy into a recession.

The S&P 500 fell 1.6% in a fourth straight session that has seen moves of at least 4% from peak to trough. The index powered higher by as much as 4% in early trading on optimism that President Donald Trump would negotiate lower rates on key allies.

Those hopes faded throughout the day. White House officials confirmed a 104% levy on imports from China would start at midnight, while China dug in with threats to retaliate. Treasury yields rose after a three-year note auction went off poorly, and measures of credit spreads tightened anew. China’s offshore currency tumbled.

All 11 S&P 500 sectors finished lower. The index ended down almost 19% from its February record, posting the worst four-day run since March 2020. The Nasdaq 100 declined 2.0%. On Semiconductor, Intel Corp. and Microchip Technology Inc. sank at least 8% to lead a rout in chipmakers. Apple Inc. and Tesla Inc. slid more than 4.5%.

These are fun times right here. I can’t get enough.

Energy, tech, and financials have become the most oversold sectors of this correction. Remember, energy was leading the way up for 2025 until recently. Crude oil is tanking. Better prices at the pump if you have any money left to buy gas.

Traders were overenthusiastic about this morning’s rally, which then succumbed to the weight of negative news: 104% Chinese tariffs, a record low Yuan, and a sloppy 3-year auction.

The relative strength on SPX closed at 21.36. Stochastics ended at 13.32. That’s pretty damn oversold unless Mr. Market decides to waterfall, which of course is possible.

The S&P 500 has been in its 11th-worst uninterrupted decline since 1940. Over the past four trading sessions, the index has dropped a massive 12.1%. This is in line with the drawdowns in March 2020, October 2008, and September 2001.

We badly need a good headline, and it has to involve China.

My buy list is ready, and I’ve checked it twice. Gotta wait. Better to pay up than to have your larynx ripped out.