Waiting for his TSLA puts to turn around. Dow -154.10 at 44247.83, Nasdaq -49.45 at 19686.78, S&P -17.94 at 6034.91

The stock market extended this week’s losses, reflecting ongoing profit-taking after last week’s record highs and a huge run since the start of the year. The three major indices spent most of the morning near their prior closing levels before selling picked up in the afternoon.

Significant moves were reserved for stocks with specific catalysts. Oracle (ORCL 177.74, -12.71, -6.7%) declined nearly 7% after a disappointing fiscal Q2 earnings report. It missed the consensus EPS estimate compiled by FactSet and issued lower-than-expected guidance for fiscal Q3.

Bitcoin and Ethereum are pulling back after their moves. It looks orderly so far.

I added ZENA as a new long today at 6.

It’s all good. Let’s enjoy this move and maybe scale back after the new year.

We’re long TSLL (2X), which I think is being revalued as AI and robotics. Hold on; don’t sell. This is a core position, IMO.

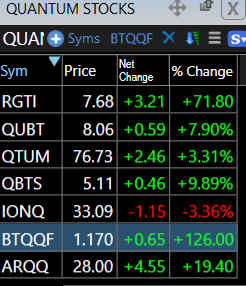

Quantum computing stocks are off the chain and running. On Friday, I called out RGTI on the chatroom at around $3.50. These moves are too fast for emails.