Dow -120.66 at 43268.94, Nasdaq +195.66 at 18987.49, S&P +23.36 at 5916.99

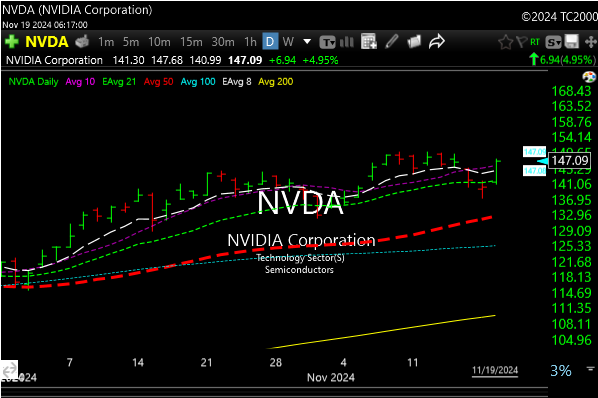

Stocks on Tuesday recovered from early losses and settled mixed, with the Dow Jones Industrials falling to a 1-1/2 week low. The broader market rebounded Tuesday, led by a +4% jump in Nvidia ahead of an expected stellar earnings report after the close on Wednesday.

Market expectations are for Nvidia to report record Q3 revenue of $33.25 billion and forecast 2025 revenue of $126.58 billion. Also, strength in the Magnificent Seven technology stocks sparked a recovery in the broader market. In addition, strong earnings results from Walmart were supportive for the overall market Tuesday after Walmart climbed +3% after reporting stronger-than-expected Q3 adjusted EPS and raising its full-year adjusted EPS forecast.

Of the 90% of companies in the S&P 500 that have released Q3 earnings, 75% surpassed the estimates, slightly below the 3-year average. According to Bloomberg Intelligence, companies in the S&P 500 have reported an average +8.5% y/y increase in quarterly earnings in Q3, more than double the preseason forecast.

The markets are discounting the chances of a 56% rate cut to -25 bp at the December 17-18 FOMC meeting.

Bitcoin hit all-time highs today and backed off.

The world will pause on its axis momentarily tomorrow afternoon when NVDA reports earnings.

“We expect a drop-the-mic performance from Nvidia tomorrow night as Godfather of AI Jensen & Co. is the only game in town with $1 trillion of AI Cap-Ex on the way with Nvidia’s GPUs, the new oil and gold in this world. We believe $2 billion beat/$2 billion guide higher”- Dan Ives.

We will know in less than 24 hours if he is right.

See you in the morning.