Wall Street ticked higher after the latest update on inflation, which came in almost precisely as economists expected. The S&P 500 rose 0.4% Wednesday, coming off one of its best days of the year. The Dow added 0.6%, and the Nasdaq ended flat. Treasury yields were steady after the U.S. government said consumers paid prices for food, gasoline, and other things last month, which was 2.9% higher than a year earlier. The data should keep the Federal Reserve on track to cut its primary interest rate in September.

The yield on the 10-year Treasury eased to 3.83% from 3.85% late Tuesday. It’s been coming down since topping 4.70% in April, as expectations have built for coming cuts to interest rates.

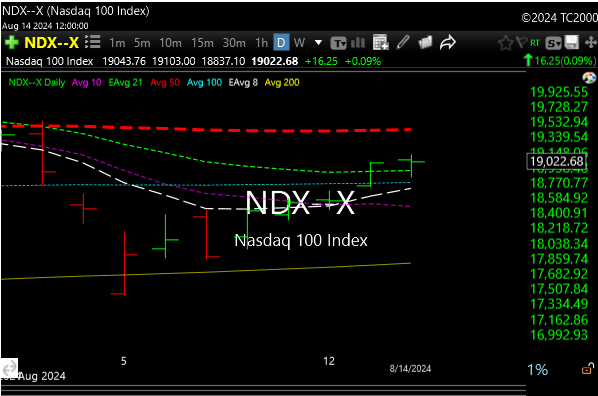

Things are looking a little better as the SPX closed above its 50-day moving average today, albeit by just pennies, but I’ll take it.

The Russell still looks tough. Today it was rejected at its 50-day moving average.

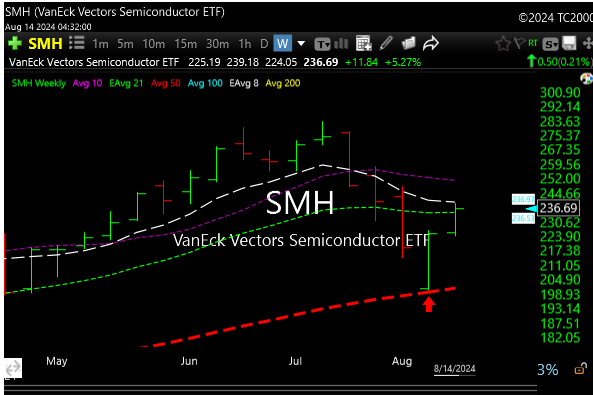

There are some damaged charts out there and some improving charts. We have monthly option expiration on Friday.

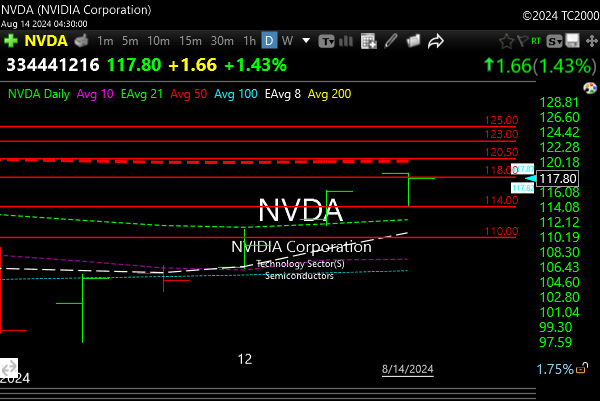

Looking for some oversold names that are trying to base a little. Keep you posted.