Dow +81.20 at 39934.87, Nasdaq -160.69 at 17181.72, S&P -27.91 at 5399.22

The Dow held on for a 0.2% gain and closed below 40,000 level after spending most of the session above it. The Dow did hold above its 21-day exponential moving average, though.

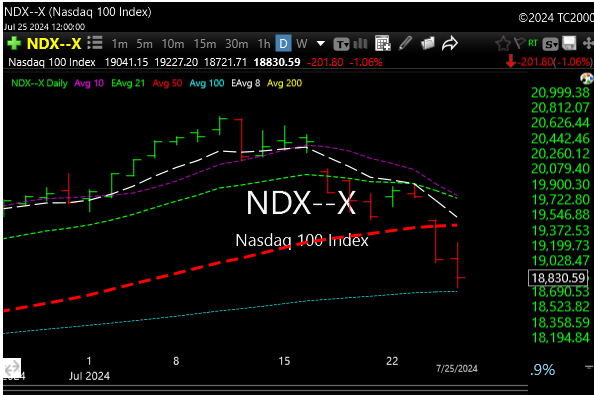

The S&P 500 closed 0.5% lower and failed to recapture the 50-day moving average on the stock market today. The Nasdaq’s losses accelerated in late trading and the composite closed 0.9% lower. On Wednesday, the tech-weighted index broke support at the 50-day moving average for the first time since May 2. It remained below that level.

The small-cap Russell 2000 outperformed with a 1.2% increase, erasing much of Wednesday’s 2% loss.

The market may be guarding themselves ahead of the crucial personal consumption expenditure (PCE) price index. The report — the Fed’s favorite measure of inflation — is released Friday at 8:30 a.m. ET. It will be the most important economic data ahead of the Fed’s meeting next Tuesday and Wednesday.

The fickle nature of mega cap stocks was evident in the performance of the Vanguard Mega Cap Growth ETF (MGK), which traded up as much as 0.9% at its high and as low as 2.1% at its low.

The Nasadq continues to get throttled and closed back near the lows of the day.

We shall see if the bulls want to step up and buy tomorrow before the weekend or see some more selling.

Crypto is getting whacked and some are oversold so I am looking around for some levels to enter.