No matter what year we are in, the challenge of a stock market that has reached new highs often comes down to this: Stocks can also gush lower.

Perhaps that was best seen among one of the popular indexes Wednesday, even if it’s not the strongest performing: the Dow Jones Industrial Average, which slumped 411 points, or 1.1%, to 38,441.

At the close, the Dow industrials finished 4% below the all-time peak of 40,007, which the index accomplished only six days ago. At that peak, the Dow Jones hoisted its year-to-date gain to a respectable 6.3%.

Yet, as the daily chart shows, the slide has been visibly steep. Plus, the Dow index dropped further below the 50-day moving average, one of the most important technical levels that savvy investors monitor.

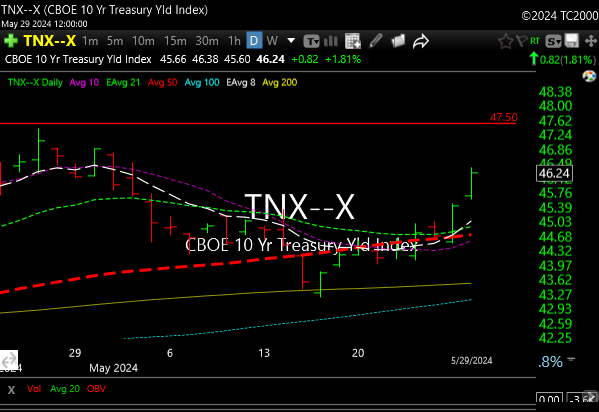

Selling turned out broadly across the stock market. And the decline arrived in tandem with another sell-off in long-dated U.S. Treasury bonds.

Meanwhile, the price of the benchmark 10-year government bond rose for the fourth time in five sessions. It also marked the seventh fall in nine trading days. Hence, the cost of money has surged in recent weeks. On May 15, the 10-year note yielded 4.35%. It’s now jumped to 4.62%.

The balance of BOIL stopped today +21.3%, C stopped -3.1%, also, PSTG reported earnings after the close and is up 10%, I will sell balance tomorrow.

See you in the morning.