Dow -305.47 at 39475.90, Nasdaq +26.98 at 16428.82, S&P -7.35 at 5234.18

S&P 500:+9.7% YTD

Nasdaq Composite: +9.4% YTD

S&P Midcap 400: +7.5% YTD

Dow Jones Industrial Average: +4.7% YTD

Russell 2000: +2.2% YTD

The stock market closed this winning week on a mixed note. The Nasdaq (+0.2%) settled at a fresh all-time high, boosted by mega-cap components, while the S&P 500 (-0.1%) and Dow (-0.8%) closed with losses.

NVIDIA (NVDA 942.89, +28.54, +3.1%) was among the influential winners from the mega-cap space after UBS raised their NVDA target to $1100 from $800. Apple (APPL 172.28, +0.91, +0.5%), Amazon.com (AMZN 178.87, +0.72, +0.4%), Meta Platforms (META 509.58, +1.82, +0.4%), and Alphabet (GOOG 151.77, +3.03, +2.0%) also acted as support for the broader market.

Meanwhile, shares of Lululemon Athletica (LULU 403.19, -75.65, -15.8%) and NIKE (NKE 93.86, -6.96, -6.9%), which were the worst performers in the S&P 500 today, registered sharp declines after disappointing guidance.

Tesla (TSLA 170.83, -1.99, -1.2%) was another notable laggard after lowering production at its China plant amid slowing EV sales.

Small-cap stocks lagged the broader market, leading the Russell 2000 to close down 1.3%. The loss in the small-cap index was related to weakness in regional bank shares, which also drove the SPDR Regional Banking ETF (KRE) to trade down 2.2%.

Treasuries settled with gains this week. The 2-yr note yield declined 12 basis points to 4.60% and the 10-yr note yield fell eight basis points to 4.22%.

The stock market rally had a strong week on a dovish Fed and bullish AI prospects. The major indexes rose strongly, all hitting record highs, though they backed off Thursday’s intraday highs.

The Dow gained 2% in last week’s stock market trading. The S&P 500 index popped 2.3%. The Nasdaq jumped 2.85%.

The small-cap Russell 2000 rose 1.6%, hitting a 23-month closing high Thursday before pulling back Friday.

The Nasdaq decisively cleared trading in early February, while the Russell 2000 is back above a range from late December to the end of February. That meant that some leading stocks broke out or flashed other buy signals.

Among growth ETFs, the iShares Expanded Tech-Software Sector ETF (IGV) bounced 2.9%, with Microsoft stock a huge holding and CrowdStrike also in IGV. The VanEck Vectors Semiconductor ETF (SMH) rebounded 4.5%. Nvidia is the dominant SMH holding, with Broadcom stock and Micron also key members.

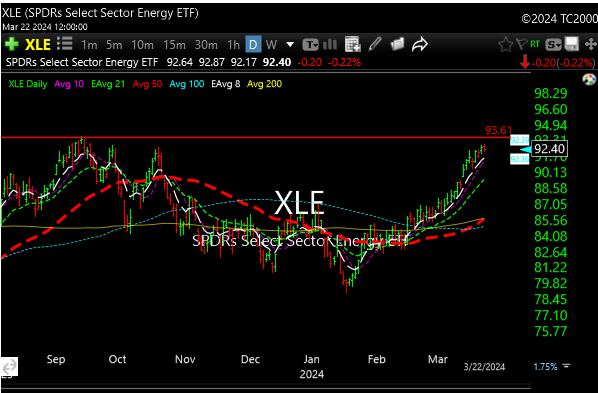

Energy

XLE seems poised for another push towards 2021 highs amid the Federal Reserve’s potential easing of monetary policy, the refilling of the U.S. Strategic Petroleum Reserve, and the expected rise in energy demand from China.

Bitcoin…………………..

Cathie Wood says Bitcoin Could Skyrocket To $3.8M By 2030 Thanks To ‘Institutional Green Light’ Cathie Wood has upped her prediction for Bitcoin, projecting it to reach $3.8 million by 2030. Wood says institutional support will help drive up the prices of King Crypto.

Semiconductors

This gets me a little nervous…………………………..

Last October when the S&P 500 was trading at 4,100, active managers had less than 25% exposure to equities.

Fast forward to today with the S&P 500 over 1,000 points higher and active managers moving their equity exposure above 104% (leveraged long).

This is the highest we’ve seen since November 2021.

****************************************************************************************************************8

We are in for another busy week of economic releases, but investors will shift their attention to inflation and the consumer economy following this week’s focus on the job market. The Consumer Price Index (CPI) and the NFIB Small Business Index will be out on Tuesday.

The Producer Price Index (PPI) and retail sales will highlight Thursday’s session, while the Michigan consumer sentiment number, industrial production, and the Empire State Manufacturing Index will all be released on Friday.

As for technicals, the Dow’s 50-day moving average and the 16K level in the Nasdaq could be the center of attention, and investors should keep an eye on the Russell 2000, as the small-cap benchmark could be gearing up for a large-scale bullish move.

Can the Nasdaq keep the party going? Seasonality says yes. Over the last two decades, QQQ has performed its best during next week’s trading session, averaging a positive 1.47% return with a 78% chance of closing the week green.

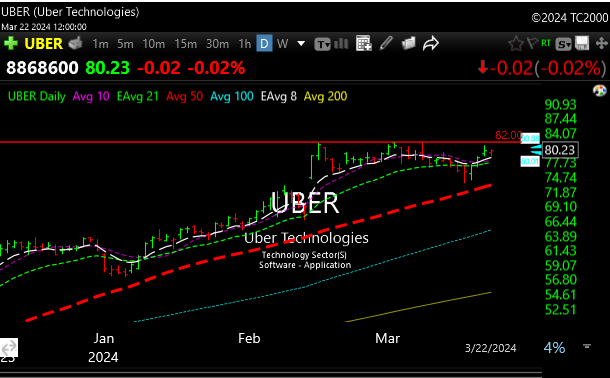

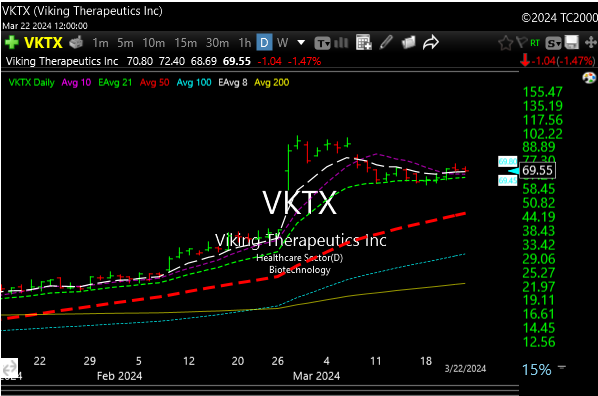

Setups

UBER- has been consolidating for about 5 weeks now. This will trigger at 82. Stop 76.75

VKTX- Triggers at 73. Stop 68

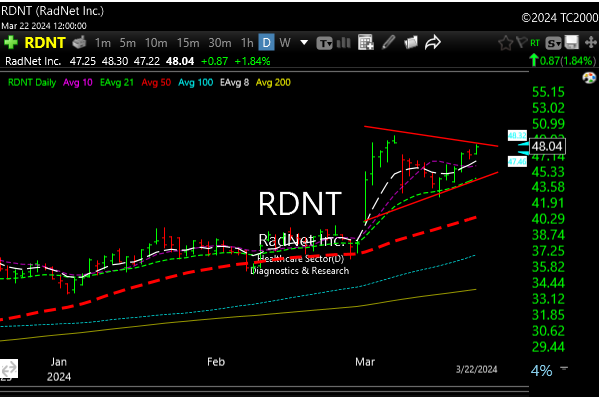

RDNT- Trigers at 48.50. Stop 45.80

CLSK- Triggers at 21. Stop 18.50

Have a great weekend. Check P&L for the new stocks and any stop/entry changes.