Bitcoin’s rally is creating roughly 1,500 new “millionaire wallets” daily, according to crypto analytics firm Kaiko Research

I knew I needed a wallet.

Dow +235.83 at 39005.49, Nasdaq +246.36 at 16265.64, S&P +57.33 at 5175.27

The stock market had a solid showing today. The Nasdaq (+1.5%) and Dow Jones Industrial Average (+0.6%) each gained more than 200 points and the S&P 500 settled 1.1% higher at a fresh record high.

Strength in the mega-cap and semiconductor spaces propelled index-level gains. The PHLX Semiconductor Index (SOX) jumped 2.1% and the Vanguard Mega Cap Growth ETF (MGK) gained 1.8% today. NVIDIA (NVDA 919.13, +61.39, +7.2%), Microsoft (MSFT 415.28, +10.76, +2.7%), and Meta Platforms (META 499.75, +16.16, +3.3%) were top performers from the space after struggling under profit-taking activity yesterday.

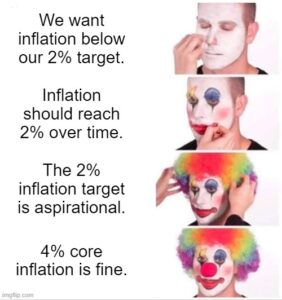

The upside bias was also related to the February Consumer Price Index (CPI), which wasn’t necessarily in line with what the market wanted to see. Still, the report failed to upend rate cut expectations as well. Core-CPI was up 0.4% month-over-month and up 3.8% year-over-year.

This was slightly hotter than expected, but market participants didn’t seem too worried due to the understanding that the index for shelter, which is expected to lessen in coming months, was the largest factor in the increase.

The likelihood of a rate cut at the June FOMC meeting stood at 71.6% yesterday and didn’t move much in response to CPI, sitting at 69.8% now, according to the CME FedWatch Tool.

Treasuries settled with losses in reaction to the CPI report, but most stocks took the price action in stride. The 2-yr note yield rose seven basis points to 4.60% and the 10-yr note yield rose five basis points to 4.16%.

The rate-sensitive S&P 500 utilities (-1.0%) and real estate (-0.4%) sectors were the worst performers today in response to the rate jump. Meanwhile, the information technology sector was the best performer by a wide margin, gaining 2.5%, thanks to its mega-cap constituents and a big earnings-related gain in Oracle (ORCL 127.54, +13.41, +11.8%). ORCL was the top-performing stock in the S&P 500 today.

Setups I like include XP, ALLY, and IIPR. Also watching ENVX again. It MUST hold $9 level. No trade.

Keep you posted. Have a great night.