SPX is back above the 200-day moving average again and fast approaching the 50-day moving average. Good sign.

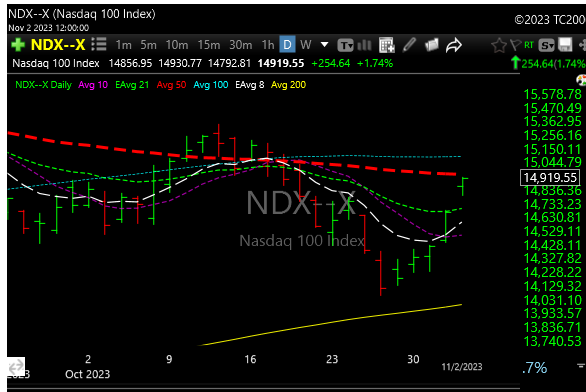

Great day for the Nazzy, closing just under its 50-day moving average

The Russell 2000 had an outstanding reversal day with help from regional banks (KRE) which were up 5.7%. I think TNA could be a great trade into year-end.

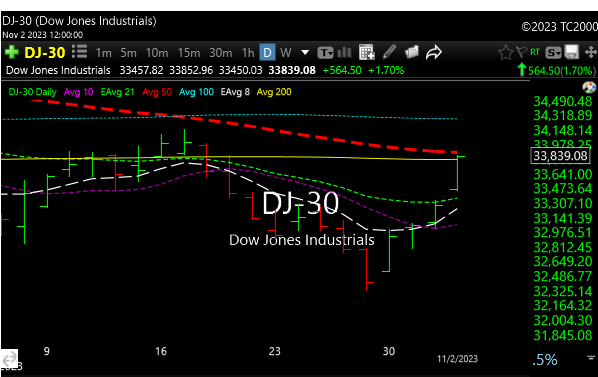

Dow Jones had a really good day. It closed just above its 200-day moving average and just below its 50-day moving average.

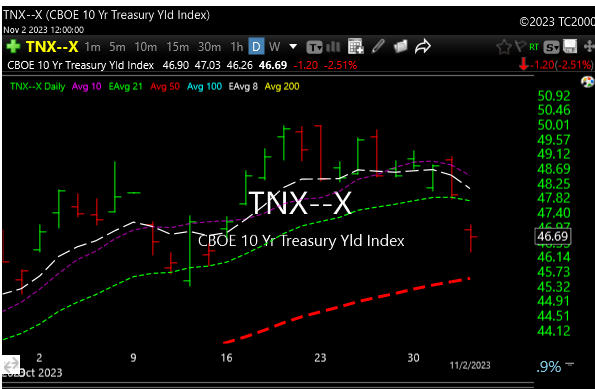

Treasury yields FINALLY took a break and in so doing, powered stocks higher.

KRE, the regional bank ETF played an important part in today’s rally. Up 5.6%. It also managed to close above its 50-day moving average by a little and is trying to break above a months-long downtrend line.

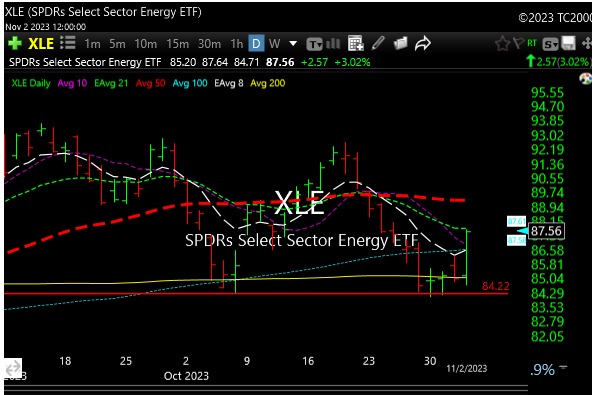

XLE– Notice that the energy ETF may have put in a double bottom. +3.0% today.

So the takeaway is that things do look better, but keep in mind we are still deep into earnings reports and we all know how a bad report can decimate a good chart. We also have to keep an eye on treasury yields because if they start running again we could see gains evaporate. With that said, I think is OK to look at some setups again.

I will go over a lot of setups this weekend and may have one or two tomorrow depending. I don’t like going all in after a one or two-day pop, but I am on the hunt. Many good names were really sold off and may present opportunities into year-end.

Markets have moved very quickly from oversold, but we are far from overbought if this is real.