Dow -198.78 at 34443.19, Nasdaq -148.48 at 13872.48, S&P -31.35 at 4465.48

Interest rates and the dollar are running.

Today’s trade started on a mixed note. There wasn’t much conviction on either side of the tape early on, leading the major indices to trade near yesterday’s closing levels. Stocks settled into a broad retreat, though, aftermarket rates bounced in response to the ISM Services PMI .

The ISM Services PMI jumped to 54.5% from 52.7% and the Prices Index rose to 58.9% from 56.8%. That is a combination that will support the Fed’s thinking that rates need to stay higher for longer.

The Nazzy has been pulling in just a bit.

The connection between tech and the US 10-year has been strong since mid-July. It looks like NASDAQ has started to notice the latest move in rates. Rates running aren’t a good thing, especially for tech, although it has looked the other way so far.

Interest expense as a percent of total wages and salaries has surged to levels that have kicked off recession in the past.

Another jump in oil prices ($87.57/bbl, +1.02, +1.2%) contributed to the negative bias today. That move, along with elevated gas prices, has stirred concerns about a slowdown in discretionary spending. On a related note, several airlines sounded a cautious note today about rising jet fuel costs.

The major indices were able to climb off their worst levels in the afternoon but still registered decent losses. The S&P 500 for its part closed below its 50-day moving average (4,475).

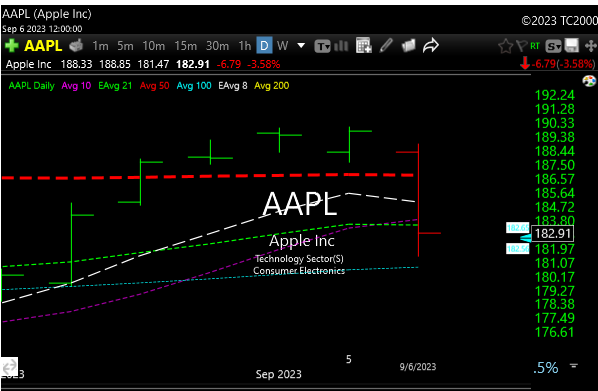

A big loss in Apple (AAPL 182.91, -6.79, -3.6%) following a few negative headlines weighed heavily on the broader market. China banned government officials from using Apple devices, according to The Wall Street Journal, and the EU Commission designated Apple as one of six “gatekeepers,” which will place it under a regulatory microscope.

Apple’s ugly candle…

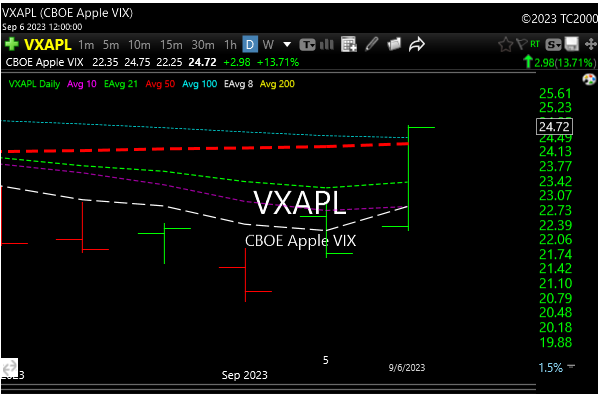

Huge down candle and the biggest rise in Apple volatility, VXAPL, in a long time. Yes, AAPL has its own VIX.

The SPX has broken that big psychological # of 4500 and has broken its 50-day moving average by a little. No alarm bells yet, but the bulls will want to recapture the 4500 mark in short order.

Meanwhile, crude oil is approaching $90 a barrel and Brent crude, (which always leads), is over $90.

XLE is breaking out and we are seeing a bullish “golden cross” on the chart which means that the 50-day, moving average is crossing above the 200-day moving average.

Keep your eyes on last night’s watchlist names (on the P&L) as they all have some breakout potential, market permitting.

Have a great night.