Dow +105.25 at 35281.31, Nasdaq -93.14 at 13645.24, S&P -4.78 at 4465.32

The market closed out the first full week of August on a mixed note in a lightly traded session. Market rates jumped in response to a hotter-than-expected PPI report for July, which created an excuse for investors to continue consolidation efforts that started this month following the stellar start to the year.

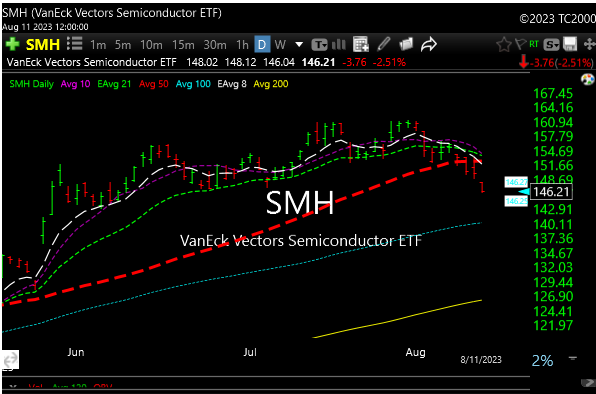

The 2-yr note yield, at 4.80% just before the release, rose six basis points to 4.89%. The 10-yr note yield, at 4.08% just before the release, rose nine basis points to 4.17%.

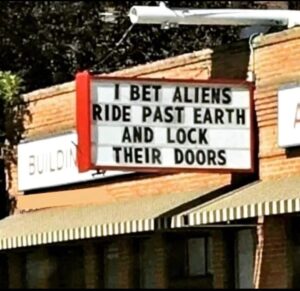

Rates rising may finally be catching up to tech as Nazzy broke uptrend line support and its 50-day moving average last week. Let’s see if dip buyers step up this week.

NAZZY

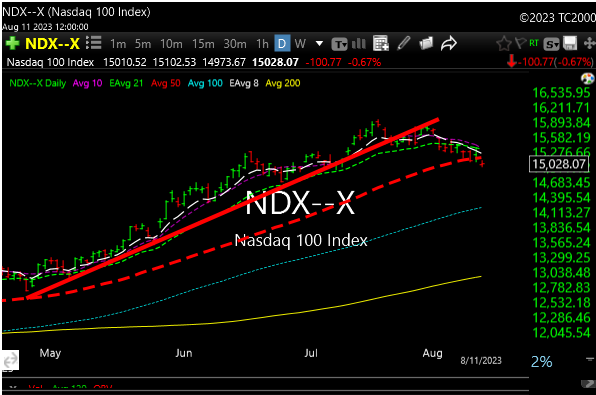

SEMICONDUCTORS

XLE– Energy led in 2022 but has sucked in the first half of 2023, but now it is starting to lead again. “Tech to energy” appears to be the rotation for the moment.

The McClellan Oscoalltor is getting a bit oversold and could be a preliminary place for a bounce, but the real sweet spot to get long is that -250 zone.

Rates are rising and that is putting pressure on stocks. Watch rates next week.

3 Month Treasury bill rate is at 5.28%, compared to 2.56% last year. That s a decent alternative to stocks, depending of course on your time frame.

Setups

EQT– Energy name setting up. Will trigger around 43.50. Stop 41.75

NOV– Triggers 21.25. Stop 19.90

Back at it in the morning.