Dow +212.03 at 33926.65, Nasdaq +219.89 at 13556.05, S&P +49.59 at 4379.68

It was a decidedly strong day for the stock market. The major indices all closed near their best levels of the session with gains ranging from 0.6% to 1.7%. The upside moves were in response to a slate of stronger-than-expected economic data this morning that helped to ease some concerns about a hard landing for the economy. (Ahem).

Namely, the May Durable Goods Orders, May New Home Sales, and June Consumer Confidence reports all went the market’s way. As a result, today’s trade had a risk-on and pro-cyclical vibe.

Rebalancing weeks can send false signals but the bulls are out. Also, many of the shitco shorted names were popping hard. That part won t last.

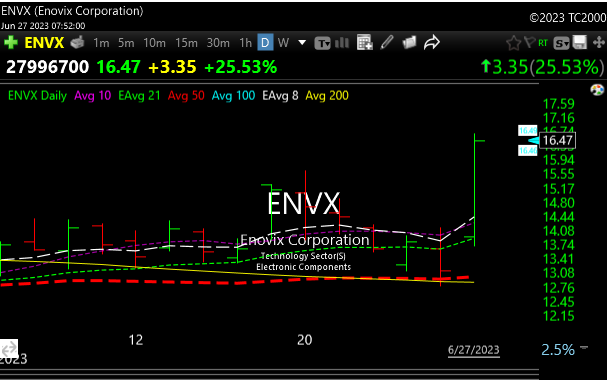

ENVX ( my pick of the year) had a hard pop today on a big government contract. The start of many in my opinion. Growth stock, longer-term play.

FBIN had a saw a breakout. Great volume in the last few days.

DAL exploded 7.0% today and AZEK had a follow-through day.

There are a few oil service names setting up. I’m tough on energy here but a chart is a chart. Nothing yet, but PBF, XOM, and BKR look good.

See you in the morning.