Dow +145.79 at 34212.03, Nasdaq +111.40 at 13573.70, S&P +30.08 at 4370.28

Overbought much?????

Today’s trade was decidedly upbeat. The major indices all closed near their best levels of the day, paced by the Russell 2000 (+1.2%). There were a few positive catalysts supporting the upside bias, but this morning’s pleasing CPI report was the biggest driving factor.

Briefly, total CPI was up 4.0% year-over-year, versus 4.9% in April, marking the smallest change since the 12 months ending March 2021. Core-CPI rose 5.3% year-over-year, versus 5.5% in April, with the shelter index (+8.0%) accounting for over 60% of the total increase.

That report seemed to corroborate the market’s view that the Fed will not raise rates tomorrow and diluted expectations of a rate hike in July. Presently, the fed funds futures market is pricing in a 5.8% probability of a rate hike tomorrow (versus 18.5% just before the CPI report) and a 64.2% probability of a rate hike in July (versus 71.0% just before the CPI report).

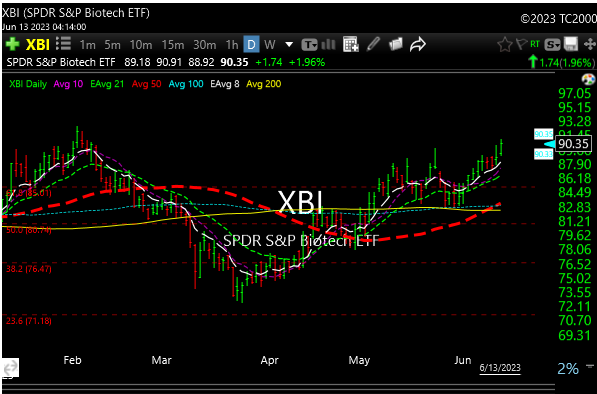

Biotech feels like it’s been in a long bear market, and it has, but see the charts of XBI and IBB, the major bio ETF’s. They both look like they want to go, but might need some sideways action or a pullback first.

XBI

IBB

Let’s watch this group closely.

See you in the morning.