NYFANG is putting in a potential reversal candle today. We always need confirmations, but momentum is fading post the massive run-up in the hottest tech stocks. The index has traded inside a perfect trend channel this year. Note that the 21-day moving is some 7% lower. That only shows you just how over-extended this space is.

What “could” be happening (it’s very early), is a rotation from Nazzy to Russell (See morning email). One day doesn’t a trend change make, so today could just be some normal profit taking, but as I said this morning, the market is always looking for that “shiny new thing”………. maybe it’s the Russell 2000.

SPX has failed twice now at that 4300 level so that’s the level to watch.

Russell 2000 (IWM) went out on the highs today in a bad tape and see the breakout above the green-downtrend line on volume a few days ago. From my perch, that’s technically significant.

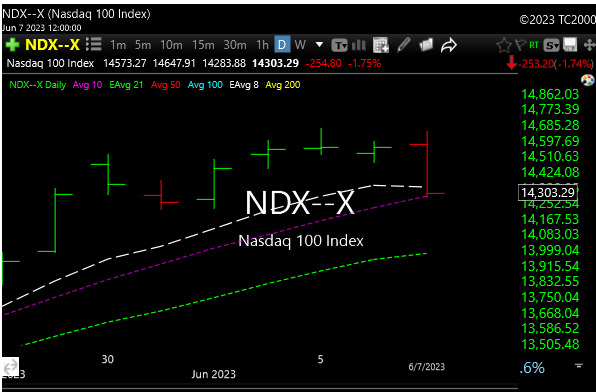

Meanwhile, the Nazzy was under pressure all day as big-cap tech saw profit-taking. Recent winners like chips (SMH) and software (IGV) saw sellers. More so with software.

Recent winner NVDA saw sellers today and broke its 8 and 10-day moving averages. Remember, this could just be normal profit taking but it does bear watching. It’s entirely plausible that they run from Nazzy and buy the Russell. I’m just throwing it out there.

Russell the clear winner since Memorial Day.

Recession? What recession?

But Apple feels no pain I guess……

See you in the morning.