Dow -109.28 at 33426.54, Nasdaq -30.94 at 12658.07, S&P -6.07 at 4193.25

Last week’s action.

The stock market kicked off this options expiration day on an upbeat note but rolled over fairly quickly. Opening gains had the S&P 500 back above the 4,200 level before the market turned lower around 11:00 a.m. ET when Fed Chair Powell began speaking at a panel discussion regarding perspectives on monetary policy.

Equities seemed to be responding to worries about the debt ceiling and regional banks, though, rather than Mr. Powell’s comments. Briefly, Powell said that inflation is “far above” the Fed’s objective, but also said that rates may not have to rise as much because of credit conditions.

The SPDR S&P Regional Banking ETF (KRE) closed with a 1.8% loss. Still, regional bank stocks had a good showing this week and Friday’s losses were not enough to offset a sizable gain in the KRE, which rose 7.8% on the week.

Ultimately, the major indices were able to climb somewhat off their lows to close with more modest losses; however, the S&P 500 remained pinned below 4,200 on a closing basis.

Treasuries saw some knee-jerk buying in response to the debt ceiling and regional bank worries coming back into play. The 2-yr note yield, at 4.35% before the news broke, plunged to 4.19% before settling the day unchanged at 4.27%. The 10-yr note yield, at 3.71% earlier, fell to 3.64% but settled up four basis points to 3.69%.

Should be a big week for the market.

So the market rallied starting Wednesday due to debt ceiling talks saying a deal will be done by Sunday, and now talks are on pause, the deal seems to be nowhere close to being done, especially considering they were considering using the 14th Amendment.

I know one thing, the 4200 level on a closing basis will be key for the bulls. If it can go above that we could see some FOMO. The bears don’t seem that empowered right now, but as we all know, things can change on a dime.

Chips and software are leading the tech charge and NVDA has been the hot chip name with much AI excitement attached to it.

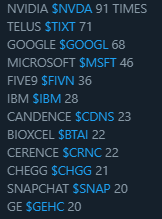

NVDA mentioned AI 91 times during its last conf. call. All the cool kids are talking AI these days. Times AI mentioned on earnings conf. calls below.

Here are some potential longs to keep an eye on this week.

LTH– Will trigger at 20.70. Stop 19.50

WFRD– Triggers at 61, stop at 58.70

GILD– Getting oversold (possible double bottom) and this one has a definable stop just below 200-day moving average (yellow line). Trigger buy at 79.00-79-50. Stop 77.00

Have a great day, see you in the casino tomorrow.