Clown man Powell just hours ago: “Conditions in the banking sector have broadly improved since early March and the US banking system is sound and resilient. We will continue to monitor conditions in the sector”

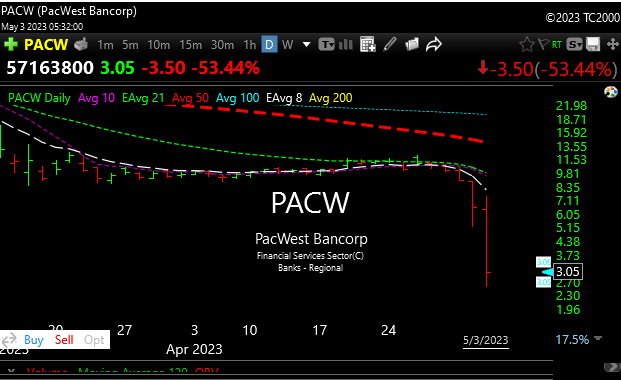

Then the PACW catastrophe happened after the market closed. LOL

With Powell and Yellen running the show we are lost.

Dow -270.29 at 33414.15, Nasdaq -55.18 at 12025.51, S&P -28.83 at 4092.02

The market experienced some volatility after participants learned that the FOMC voted unanimously to raise the target range for the fed funds rate by 25 basis points to 5.00-5.25%, which was largely expected.

In total, today’s FOMC decision and press conference weren’t as market-friendly as the market had hoped it would be.

Some of the remarks that participants were presumably reacting to included Powell’s acknowledgment that the process of getting inflation back down to 2.0% has a long way to go. He added that if the Fed’s inflation forecast is broadly right, it would not be appropriate to cut rates.

That view stands in contrast to what price action in the Fed funds futures market is indicating. The fed funds futures market is pricing in three rate cuts before the end of the year, according to the CME FedWatch Tool.

What we’re seeing in the banking system suggests that we have more volatility and pain ahead in my opinion.

Fed days are tough to trade and don’t always give the real picture. Let’s see where she goes tomorrow after they process Fed Speak overnight.

See you in the morning.