It’s pretty ugly out there. It looked like the market wanted to stage a rally in the morning but it fizzled quickly and the sellers pressed.

We have the Fed, CPI, and PPI next week so the longs are stepping to the sidelines. They would rather pay up next week than get caught if things go sideways for them.

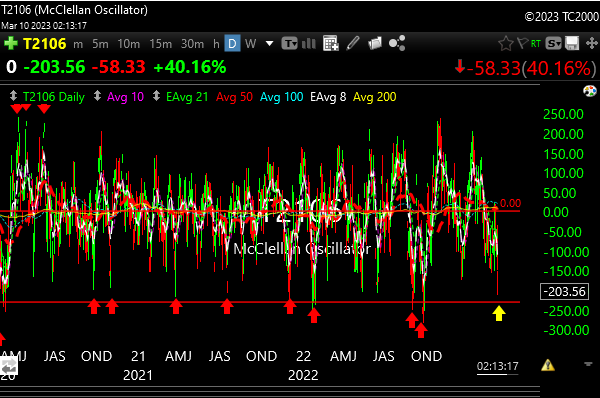

The McClellan Oscillator, my favorite overbought/oversold indicator when things get “extreme”, is nearing that sweet spot where you can look at longs again. At the very least, time to tune up your watchlist. It is still hairy out there today and we may not see a short-term bottom get printed until next week though.

The greed-o-meter is right on the “extreme fear” line which has been a pretty decent “contra-indicator” so we may see a nice oversold bounce coming soon.

Dow, SPX, and Nasdaq are red by 1.0 to 1.5%.

The Russell 2000 though is really coughing up blood, down 3.3%.

Many think the Russell is all small-cap growth stuff, but what they don’t realize is that the Russell has huge exposure to smaller regional banks and we all know what’s been happening to financials the last couple of days.

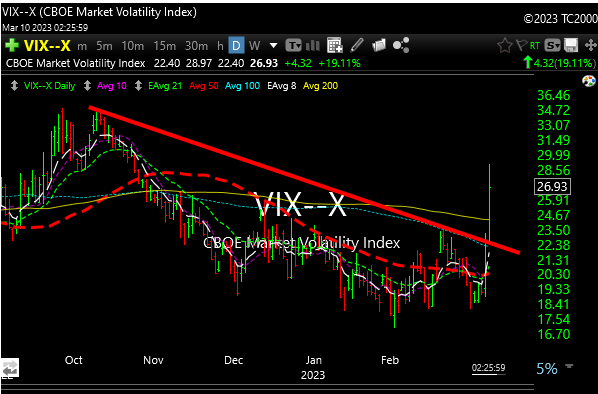

The downtrend breakout in the VIX (volatility/fear index) also coincides with the extreme fear chart above.

Hang in there. I’ll be doing a full review of everything over the weekend.