Left and right were filthy good on performance this year in a horrible market, but she topped the cake. Congress must be outlawed from insider trading. Whatever happened to blind-trusts for these characters?

Not the best opening for 2023, but a turnaround Wednesday wouldn’t surprise me. Volume is still light (liquidity still sucks).

Energy got hammered today, nat gas has been throttled. Those that called for natty to do a moon shoot were wrong. It’s been pretty warm in Europe. As a result, coal has been coming down as it can trade with nat gas prices.

Still, 364 days to go, so don’t get too crazy.

AAPL got hammered today, the chart looks horrible. They are scaling back on production so the market decided to take it to the woodshed.

As I said in my weekend post, they could barf this market up in the first quarter, maybe even the first 5-6 months of the year. There will be some great tradeable rallies along the way though, so all is not lost.

China has had it with COVID and is proceeding as if nothing ever happened. China did well today (see FXI, KWEB). See BIDU, PDD, and BABA.

Watch WYNN (exposure to china) as well as MLCO. China casinos do well when “their” risk is back on. Not a recommendation yet, just an observation at this point.

Gold and silver put on a good showing today. I’m watching PAAS, WPM, AGQ (silver), and NUGT in the gold space.

I may go nuts in this space like we did a couple of years ago. I’m watching the charts closely.

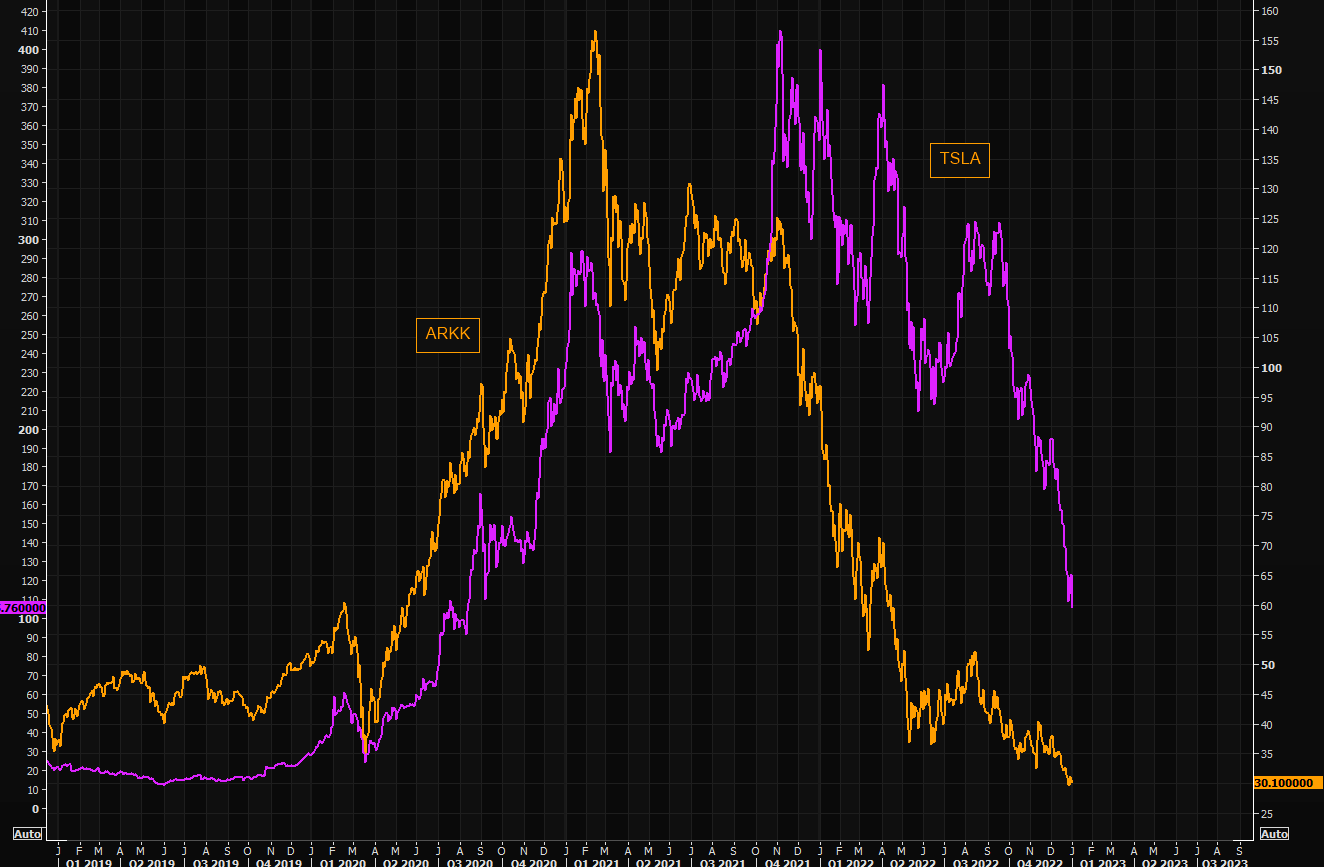

All manias and panics tend to have the same cycles. ARKK was the epicenter and we have seen the “excess” just being flushed through the system. The same thing has been going on in Tesla. Two different “assets”, but the psychology is the same. Chart showing ARKK and Tesla.

About that January Effect……

1…the January Effect is the most significant following years where the SPX had a double-digit gain or loss.

2. Over the last 50 years, the SPX has had a loss that exceeded 10% on eight occasions (2022, 2008, 2002, 2001, 2000, 1977, 1974, and 1973)

3. Following those 7 years (2022 omitted), the succeeding January produced a negative return 5x (71% hit rate) with a -61bps average return (-156bps median return).” -JPM

Let’s throw out the playbook and just trade em’ as we see em’.

Have a great night.

Keep you posted tomorrow.