The S&P 500 and Nasdaq both climbed 1.5%. The Dow added 1.6%, closing up over 500 points. The Russell 2000 small-cap index showed slightly more strength, up 1.7%.

The S&P 500 is testing resistance at its 50-day moving average.

Crude oil gained 2.9% to $78.45 per barrel. The Energy etf (XLE) popped by 1.9%. Natural gas rebounded by 2.3%.

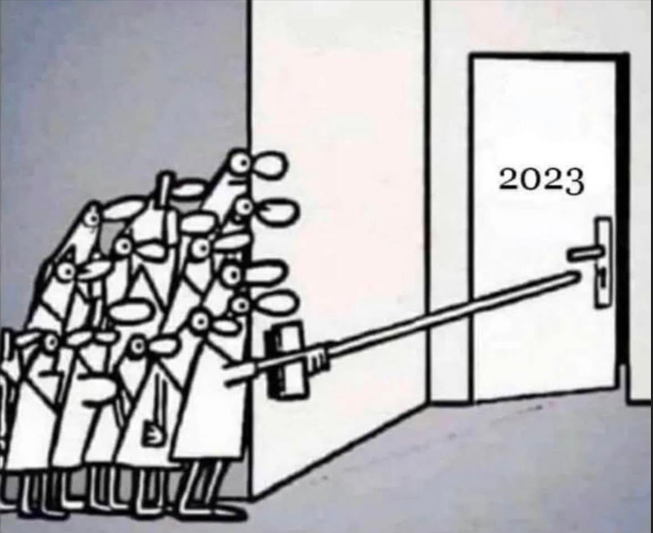

I thought the above picture was funny. I don’t think 2023 will be that bad, although I do think our mettle could be tested in the first 4-6 months of 2023. And I do think a final retest of the October lows is a great possibility. That’s about 400 points lower if it happens.

Energy has pulled I but I still like it into 2023.

With 2022 coming to an end soon, oil bulls and bears alike can’t help but reflect on the tale of two halves. The first half of the year can be best described as nothing but bullish with a dash of fear sprinkled in here and there. While the second half of the year can be best described as frustrating, conflicting, and confusing.

2023 is the year when the rubber meets the road for energy. In 2023, we have will have:

- A slowing global economy

- No more SPR releases (for now, no midterm elections)

- No more China-related COVID lockdowns.

It may very well be the first year since COVID started in 2020 that we have a normalized market environment. Without the SPR releases and the arbitrary demand suppression, the global oil market will show its true colors to everyone. This will also come at a time when the world finally gets to witness just what happens when you underspend on upstream Capex for 6 years straight (2015 – 2021).

I also think a theme for 2023 will be BIOTECH.

We’ve avoided this group, and rightfully so for a while now, but it’s always been my favorite group to trade.

Risk is still off, but when it comes back, biotech (XBI, IBB, LABU) will outperform….. and by a big margin.

More to come in the yearend report.

PDSB triggered today.

Have a great night, looking forward to 23.