The market managed to end a wounding bear run Tuesday, but there is a long way to go to recover from recent bleeding. While a four-day losing streak came to an end, it was hardly in an emphatic fashion.

The S&P 500 ended the trading day with a slender 0.1% gain. The benchmark index remains stuck below the 50-day moving average, though it remains within striking distance. At 3821, the S&P 500 still lies down almost 7% from the recent high it made on Dec. 13.

The Nasdaq closed the day essentially flat. The tech-heavy index remains down almost 33% so far in 2022. It sits 3.5% below its 50-day line and is nearly 9% below its Dec. 13 peak.

The Dow fared best once again out of the major indexes. It managed to turn in a gain of 0.3%. For a second straight day, it tested the 50-day moving average, and the Dow managed to close above it.

The market was slightly green but index charts are still bearish so they need some more work.

The big question is when the recession will finally get “discounted”.

They won’t ring a bell for us at the bottom, but it might take a retest of the October lows to double bottom and squeeze out the sellers.

Still careful for now.

Crappy market, but there are always some charts that look like gems.

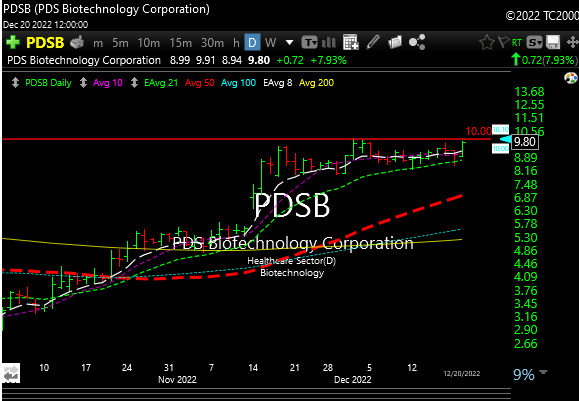

I will add PDSB at a $10 trigger. It’s a biotech, so riskier. Put a stop around $8.50 which is just below the 21-day moving average. Smaller size in this market.