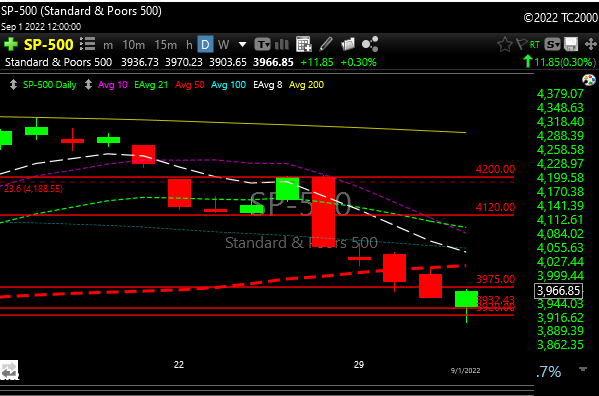

Every support level I have posted has been breached. But….today we printed what could be viewed as a hammer candle.

Normally I post bar charts, but the candlesticks shows this better.

This could be nothing (follow-through up important) but you usually see these at the “end” of a bear move. Not a market bottom, but maybe a tradeable bottom.

It’s tricky because tomorrow is a Friday before a 3-day weekend, so absent good news( we don’t have any), any move higher would be strictly technical in nature.

The bears have a shot to crush the bulls even more tomorrow, but by the same token, the bulls could squeeze some shorts.

We are still seeing very light summer volume, so due to illiquidity, moves can be much more dramatic, up or down.

Biotech has pulled back. Not a lot of positive takeaways with this market, but seeing two positive relative strength days in a row in a bad market in XBI. It also filled the Aug 2 gap and bounced which can be viewed as a positive. Maybe LABU is a play for a trade if the market bounces, but I’m not loving anything here and it wouldn’t surprise me if we retest June lows.

We are back to fear on the greed-o-meter and AAII bearish sentiment s moving up again, so they usually like to make everybody look stupid when this happens and rally the market.

See you in the morning.