Dow: +322.55…

Nasdaq: +207.74… S&P: +58.35…

The stock market had a positive bias for the entirety of today’s session but remained in a narrow range until the final 30 minutes of trade, where the major indices pushed to new session highs. Today’s buying was fueled by the emerging hope that Fed Chair Powell’s comments tomorrow regarding the rate-hike path will align with what the market wants to hear. The 10-yr note yield moving markedly lower was another supporting factor for today’s buying effort.

XME and CCRN were triggered today. Sold some CCRN on the spike. Also took partial profits on CF and MOS today. Check the P&L on the website for the adjustments.

Setups

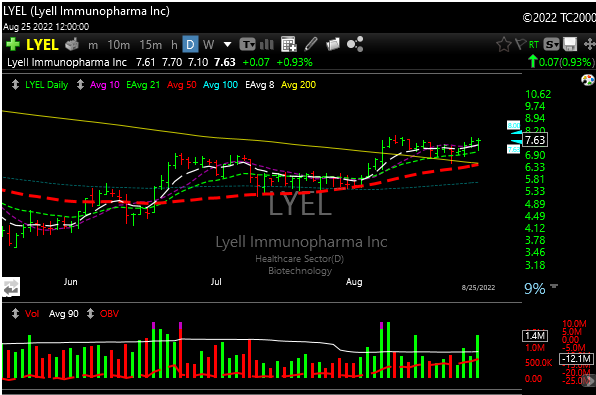

LYEL– (Biotech-riskier) Tigger at 7.85

I’m still feeling like commodities could lead the charge into year-end. Oil, gas, coal, steel, metals (not gold/silver yet) and soft commodities are showing some serious accumulation just when everyone left them for dead.

Interesting that the market showed strength with higher dollar and rates today as we go into Powell’s comments tomorrow.

Fed heads were all barking hawkishly all day today too. Maybe a big up day tomorrow?