Dow: -154.02…

Nasdaq: -0.27… S&P: -9.26…

Today’s trade was marked by a lack of conviction on either side of the tape. The major indices could not escape their narrow trading ranges and closed with modest losses. Market participants were playing a waiting game ahead of Fed Chair Powell’s speech at the Jackson Hole Economic Policy Symposium on Friday. The 10-yr note yield remaining above 3.00%, rising oil prices, and a weak July new home sales report also acted as limiting factors today.

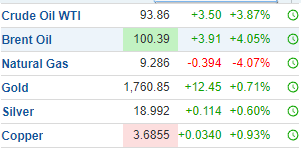

Energy (XLE, USO)was the only area of the market with concerted buyer interest. The S&P 500 energy sector closed way ahead of the broader market, up 3.6%. It was boosted by an upside move in WTI crude oil futures ($93.76, +3.13, +3.5%) following reports that suggested OPEC+ is likely to cut production or reduce the rate of its production increase at, or before, its September 5 meeting.

The greenback pulled back a little today and that helped energy. Energy stocks are paying more dividends than any other sector in the S&P 500 today. Also, huge cash flows, buying stock, paying dividends, and paying off debt at a record clip. Don’t discount the energy sector quite yet.

Nat gas was going swimmingly well until news broke that the Freeport LNG pipeline which had a problem a couple of months ago will take another month to open. It was expected to open any day. That pipeline provides a ton of nat gas to Europe, so the knee-jerk reaction was to sell nat gas and related stocks like SWN, AR, and others.

15 minutes nat gas chart on the reaction to the news.

In my opinion, this is very temporary.

Crude did great today and energy stocks did as well. Coal was flat as it digested recent gains.

I still believe crude oil and energy stocks will have a strong fourth quarter. That’s my story and I’m sticking to it.

Meanwhile, housing is having some problems.

TELL and DO triggered long today.

Goldman is looking for $125 oil net year. Who knows if those lizards will be right, but remember that the past three recessions saw oil prices rally even as demand declined.

This market is still so hard to trust. This recent rally may only have been a bear market short-covering rally as most are in a bear market.

Play smaller unless you’re a day trader. Then do whatever the hell you want.

I’m watching XME again. Cup & Handle much? See you in the morning.