“Good to see core inflation moderating” -Joe Biden

Friday

Dow: -880.00…

Nasdaq: -414.20… S&P: -116.96…

YTD

Dow -13.6% YTD

S&P 500 -18.2% YTD

Russell 2000 -19.8% YTD

Nasdaq -27.5% YTD

Those peak inflation folks from last month are just adorable.

We also have the lowest consumer sentiment in history.

It’s hard to sugarcoat the brutality of a bear market.

The stock market ended the week on a disappointing note, pressured by hot inflation and weakening consumer sentiment. The S&P 500 fell 2.9%, surrendering 5.1% for the week while the Nasdaq (-3.5%) underperformed, losing 5.6% this week.

Equities recorded nearly half of their losses at the open, responding to the May CPI report, which did not show the desired relief in price pressures. Instead, the yr/yr CPI rate accelerated past its March high to a level not seen since early 1982.

Energy

XLE caught a pullback with everything else but daily and weekly charts are still bullish. XLE could pull back to the 85 level and still be fine.

Energy is now struggling to keep up with WTI’s recent strength, but the glass-half-full argument is that the sector now screens even cheaper vs. crude, with E&Ps still only pricing in less than $70 a barrel oil.

The AUM in commodities is lower today than it was before the invasion of Ukraine; with the exception of oil, there’s been de-risking in almost every other commodity market.

I issued some potential trigger prices in energy last week, keep an eye on them as they could turn up quickly.

Nazzy

Tech and growth are still a mess and continue to get sold on every rally. ARKK broke the psychologically important $40 level intraday on Friday.

Retail

Retail store inventories are rising hard and fast. The consumer has pulled back and the Dollar Store is now the Dollar and a Half store. I expect XRT to go even lower.

The Fed

The Fed meets Monday. The market anticipates a 50 bp increase. Would they go 75 bps like they should? I doubt it.

Housing

Feels like early stage of the great bubble pop, and there’s a long way down.

We get to spin the wheel again this week. My gut tells me we could see some volatility into the Fed meeting/comments on Wednesday.

Let’s get some price discovery on Monday before any new setups. Plenty of nervous Nellies out there. But I am focusing on energy names on dips.

P.S.

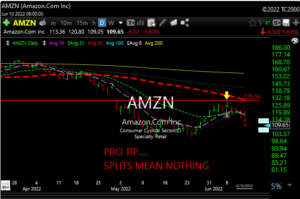

If you chased the AMZN split on Monday because it was finally your chance to “get in cheap”, you’re down $20 or 15.0%.

The financial media has become a wild, wild west of misinformation. Be careful out there.