Dow: -269.24…

Nasdaq: -88.96… S&P: -44.91..

The market fell backward today, slipping on rising energy costs and renewed angst about the economic and earnings growth outlook.

A series of headlines ignited the growth concerns, which led to some fairly broad-based selling interest.

- Intel (INTC 41.23, -2.30, -5.3%) said the macro environment has been weaker and that circumstances at this point are much worse than it had anticipated coming into the quarter.

- Scotts Miracle-Gro (SMG 93.24, -8.94, -8.8%) slashed its FY22 (Sep) EPS outlook well below the current consensus estimate, noting its fixed cost structure has seen significantly greater pressure due to replenishment orders from its retail partners not being what it expected since mid-May.

- The OECD cut its 2022 global GDP view to 3.0% from 4.5%.

- The Atlanta Fed’s GDPNow model estimate for Q2 was lowered to 0.9% from 1.3%.

- The Reserve Bank of India raised its key lending rate by a larger-than-expected 50 basis points to 4.90% (a 40 bps increase was expected), following suit with the Reserve Bank of Australia’s larger-than-expected rate hike on Tuesday.

- The MBA Mortgage Applications Index was down 6.5% week-over-week, driven by a 7% decline in purchase applications and a 6% decline in refinancing applications.

We all saw a note late in the day that the teamsters union said US food work stoppages are ‘Imminent’.

That should about send food inflation into orbit.

Yesterday, Target, (TGT) said that their overall inventory rose 43% as consumers are spending less. Retail is seeing less spending and higher prices, a classic sign of a recession.

The FED finally admitted we have 1970s-level inflation. Fed Chair Volcker had to raise rates to 20% to tame inflation back then. Powell has us at 0.75%.

Should be an interesting summer.

WTI crude futures settled the day up 2.0% at $121.96/bbl. At one point, natural gas futures were up as much as 4.0% to $9.66/mmbtu, yet they hit a wall of resistance late and tumbled into their close, settling the day down 7.2% at $8.67/mmbtu.

But the worst is likely yet to come. When Chinese lockdowns fully ease, oil demand will surge, pushing up prices. The same will be true for natural gas prices, which in turn affect electricity and heating prices.

Energy is now 4.8% of the market cap of the S&P500– still well below its 13% mark immediately after the Great Financial Crisis.

The simple inescapable reality remains that the Energy sector as a whole is still the most underweight position in the S&P 500 Index at only 4.8% at the end of May. For context, Apple alone is 6.59%.

I still like energy ( oil & coal), especially on any dips. Goldman and Morgan booth looking for $150 a barrel next.

Here are some names I will add to P&L if they hot trigger price.

MUR– Through the $45.50 level.

VIST– Through 9.85

CNQ– Through 69.20

PFE– Through 54.50

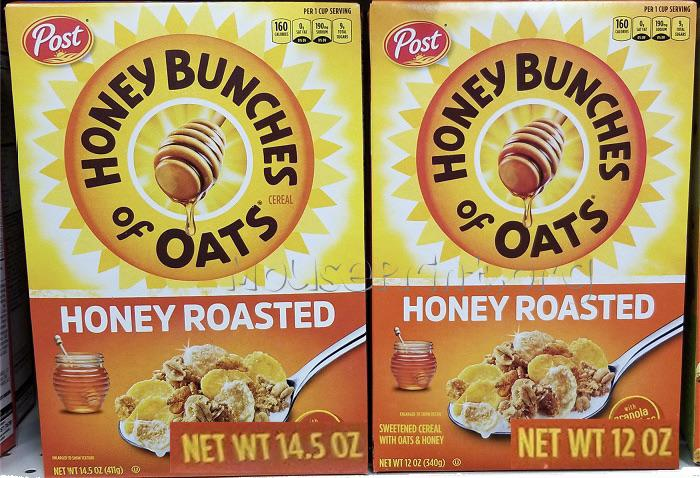

Honey Bunches of Oats, which now has 17% less. That is almost two bowls of cereal less as their 14.5-ounce boxes went down to only 12 ounces.