Today

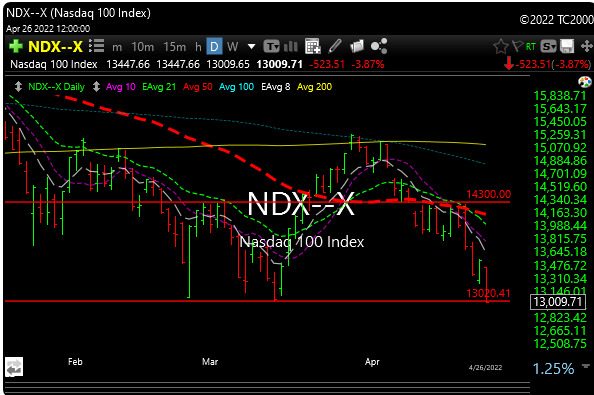

Dow: -809.28…

Nasdaq: -514.11… S&P: -120.92…

YTD

Dow -8.5% YTD

S&P -12.4% YTD

Russell -15.8% YTD

Nasdaq -20.2% YTD

If you are doing better than those year-to-date returns above then you are performing on an absolute, not a relative basis which is a good thing. But if you are overweight tech then you don’t have a shot.

We have talked about tech not being the place to be for weeks now.

Semiconductors were down almost 6.0% today.

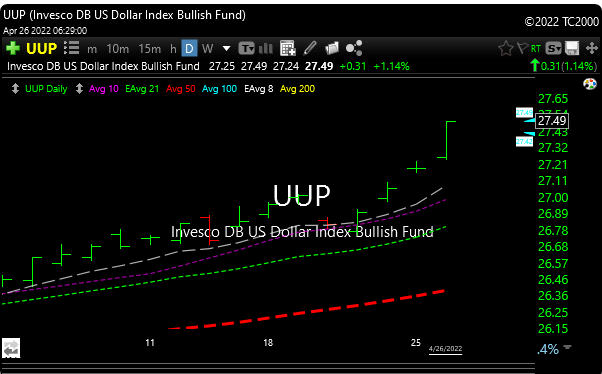

The greenback has exploded so still pressuring commodities.

This is a flush of epic proportions and there will be “long-only” tech funds that go out of business. Just too much pain. Remember, if you are down 50% you need 100% to just get even.

Good luck Kathy Wood and the ARKK funds.

The S&P 500 fell 2.8% on Tuesday in a relatively broad-based decline led by the growth stocks. The Nasdaq (-4.0%) and Russell 2000 (-3.2%) both underperformed while the Dow fell 2.4%.

Losses broadened out as the day progressed, though, leaving ten of the 11 S&P 500 sectors in negative territory and the S&P 500 below yesterday’s intraday low (4200.82) by the close. Investors braced for further downside, evident in the 24% pop in the VIX.

GOOGL dropped 7% on bad earnings after the close and guidance even though they announced a $70B stock buyback.

FB and AAPL are on deck. They better be good.

The energy sector (+0.04%) was the only sector in the S&P 500 that closed higher, although it couldn’t keep pace with the increase in oil prices ($101.42, +2.79, +2.8%), which reclaimed $100 per barrel.

Coal outperformed today (+6.8%) (BTU, CEIX, and ARCH).

Solar ain’t on time, and coal works.

We could have further to go on the downside. All the indexes seem to be getting liquidated. That looks and feels different than just selling.

When you look at something every day sometimes you stop seeing it. I’m out of that small piece of EXPR at the open. It’s been there since the Carter administration.

It’s been brutal lately, and we will rally, but things have changed, and I still think strong rallies may get sold unless inflation miraculously goes lower and rates go lower????

Everyone wants to put a two-dollar pistol in their mouth so we rally soon.

P&L here.