Dow: -280.70…

Nasdaq: -328.39… S&P: -57.52…

We all know by now that the Fed is squeezed in a corner. We know that they have already said that the next two rate increases could be 50 basis points each, but when Fed members get a microphone, like they did today, and reiterate what we already know, the market tanks.

Raising rates into weakness could be a big problem.

The S&P 500 fell 1.3% on Tuesday, as a sharp rise in interest rates weighed on the growth stocks and risk sentiment following some hawkish-sounding Fed commentary. The Nasdaq (-2.3%) and Russell 2000 (-2.4%) underperformed with losses of over 2.0% while the Dow fell 0.8%.

It’s a shitty April so far. Hard to trade. April is supposed to be good for the market and they say “sell in May and go away”. Maybe it will be the opposite.

They loved oversold tech yesterday and today they couldn’t sell it fast enough. This action tells me they are selling rallies.

In my opinion, it’s a scared market. Hard to fight that. Semiconductors were down over 4.0% today.

Earnings are here and watch guidance. The pollyannas will wax bullish, but depending on the industry, most sectors will get hammered.

I always say buy protection when you can, not when you have too. Not a bad range for VIX. UVXY as a hedge over the next few months might be a good thing.

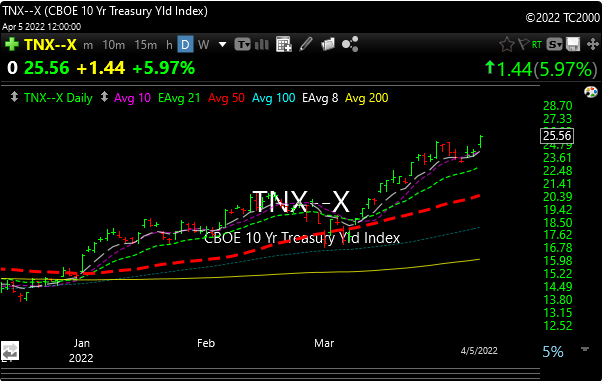

Buy that house now, Yields are ripping.

I spoke to a realtor today. The market is still hot, but it is always is at the top. They are suggesting adjustable-rate mortgages now for those that waited too long. Did folks miss the boat on low rates? Panic buying setting in.

If things are so good, why are housing stocks collapsing?

See you in the morning.

Oh cool. BLM used $6 million to buy a lovely crib in Southern California.