The S&P 500 rose 1.2% on Thursday, extending its rebound rally to a third straight day. The Dow (+1.2%) and Nasdaq (+1.3%) kept pace with the SPX while the Russell 2000 (+1.7%) pulled ahead of large-cap names.

All 11 S&P 500 sectors closed in positive territory. Strikingly, the market was undeterred by an 8% rebound in oil prices ($103.43, +8.01, +8.4%), which was catalyzed by Russia refuting yesterday’s reports that described progress in peace talks with Ukraine. Shocker. Ain’t hapn’n.

Tomorrow is Friday and its also triple witching of options which can sometimes give us some movement.

Nasdaq reversed right on the big 14k level, but note that Nazzy hasn’t gone anywhere since lows post the late January sell-off. We have seen big oscillations, but Nazzy still lacks a short-term trend.

The first bigger support is down at 13400, and the next big resistance should we close above the 14k area is the 14400/600 area, right where the 50-day moving average comes in.

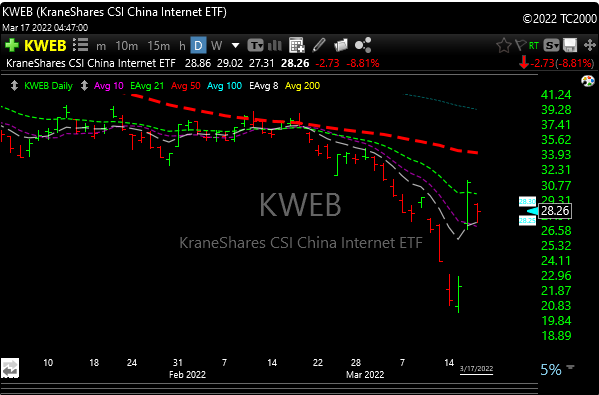

Hedge funds puked Chinese stocks going into the biggest squeeze ever. Not only that, but net exposure to “hot” Chinese internet stocks fell to the lowest since 2015 going into KWEB‘s mega squeeze. (BABA, BIDU etc..)

Has biotech (XBI) “finally” bottomed????? Double bottom off the Fibbonachi level tells me it has. I am feeling the need to put away some LABU for six months. At some point, the sellers just get done. Let you know.

Never thought I would become a coal and uranium bull, but I still like those groups. They can be volatile though.

CCJ and URA had 7.0 and 9.0% moves today on the news that the Senate is moving forward with a bill to prohibit the importation of uranium from the Russian Federation… HTS codes include uranium ores, natural uranium, uranium enriched in U-235, and thorium.

I still like BTU as it continues to move around, but nice bullish cup/handle pattern. Can see 28-30 with a little patience. Buyable.

One to watch, but still hard to trust is MARA. It needs crypto to rally but it broke above its 50-day ma today with decent volume so maybe the start of something.

ACI was highlighted over the weekend. I still like the bull flag and looks buyable here.

See you in the morning.

P&L here