SPX back over 200-day moving average, but still, work to do.

*******

Sometimes it’s just not your time to shine.

The chip shortage is becoming a real big problem. (SMH, F, GM)

******

Friday

Dow: -21.42…

Nasdaq: +219.19… S&P: +23.09…

YTD

Dow -3.4% YTD

S&P 500 -5.6% YTD

Nasdaq -9.9% YTD

Russell 2000 -10.8% YTD

The S&P gained 0.5% on Friday in a session featuring earnings relief from (AMZN +375.88, +13.5%) and (SNAP +14.25, +58.2%), a surprising January employment report, rising Treasury yields, and uncomfortably high oil prices ($92.30/bbl, +2.08, +2.3%).

Amazon carried the S&P 500 consumer discretionary sector (+3.7%) to the top of the sector leaderboard. The financials (+1.7%) and energy (+1.6%) sectors followed suit, while the materials (-1.7%), consumer staples (-1.2%), and industrials (-1.1%) sectors were among six sectors that closed lower.

The second trading narrative was that the January employment report, which included surprisingly strong jobs growth and higher-than-expected wage gains, would force the Fed to be even more aggressive with rate hikes.

Facebook got annihilated last week. First time in their history they lost users. FB bought back about $24.5B in the first three quarters of 2021 combined. Then spent $19.2B buying shares in Q4. 21.7M shares in October at $326.20. In November it purchased 21.6M shares at $335.09. In December it bought 14.73M shares at an average of $329.97. Where would it be without buybacks? $150?

Energy

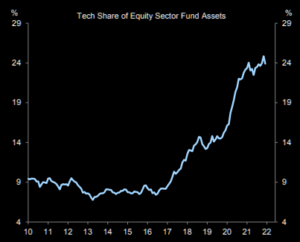

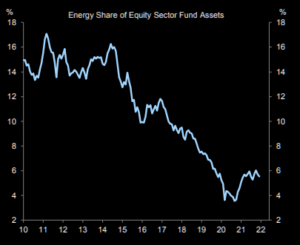

Energy has been on fire lately, beating tech in a big way. The short-term XLE chart is getting extended and probably needs a rest (maybe this week), but take a look at the positioning below in tech vs. energy. If this becomes a massive rotation (sell tech/buy energy) then over time the energy space has a long way to run.

Setups

By the way, DWAC & CFVI which were highlighted Thursday had very nice days on Friday. Both are seeing increased call buying. Especially out-of-the-money calls. Open interests are rising and both stocks have the potential for a squeeze if prices start to rise.

OSTK– is bull flagging after a massive selloff. Still a lot of work to do but if crypto gets hot again this one will play along and retest the 50-day moving average up around $60.

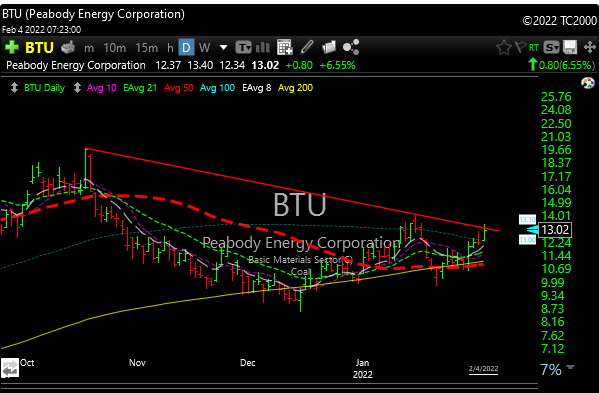

BTU– coal is back in shape and BTU after the pullback looks ready to go again. It’s at a 5-month downtrend lien. Targets 14-16. (AMR, ARCH, and HCC all look good in this sector).

More setups as we settle into the week.

See you in the morning.

P&L here