Dow: -518.17…

Nasdaq: -538.73… S&P: -111.94…

The S&P 500 fell 2.4% on Thursday, pressured by disappointing earnings results and guidance from Meta Platforms (FB 237.76, -85.24, -26.4%) and an increase in interest rates. The Nasdaq Composite dropped 3.7%, but the Dow Jones Industrial Average (-1.5%) and Russell 2000 (-1.9%) didn’t fare as bad.

AMZN popped in after hours, so that may help things at the open (remember MSFT), but we will see how sticky the gains are. AMZN was down 8% today and is now +5.0% in aftermarket trading.

I added IBM and CVE today. Energy (CVE) is strong and IBM is showing good relative strength.

The S&P 500 communication services (-6.8%), consumer discretionary (-3.6%), and information technology (-3.1%) sectors fell between 3-7% amid weakness in the mega-cap stocks. The consumer staples sector (+0.01%) closed fractionally higher due to its defensive qualities.

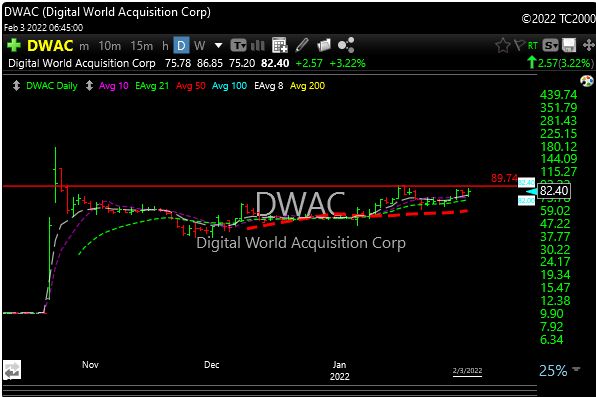

Two very risky longs with upside.

As FB and TWTR get destroyed, these two new social media companies may benefit.

DWAC is the new Trump platform, and CFVI is the new Rumble social platform. Both are SPAC’s. Use your own risk parameters but both charts may be percolating.

Updated P&L here