Dow: +406.39…

Nasdaq: +469.31… S&P: +83.70…

Nice move above the 200-day moving average today.

The S&P 500 rose 1.9% today in a steady advance paced by the growth stocks. The Nasdaq (+3.4%) and Russell 2000 (+3.1%) outperformed with gains over 3.0%, while the Dow underperformed on a relative basis with a 1.2% gain.

There weren’t any specific macro catalysts today. Instead, the market received support from month-end rebalancing activity that disproportionately benefited growth stocks after a dismal January, improving technicals as the S&P 500 reclaimed its 200-day moving average (4437), and short covering in some way oversold technology stocks.

All 11 S&P 500 sectors closed in positive territory amid another strong finish.

Today was the follow-through day that I was looking for. Many times the first day grind higher is a head fake, but it looks like the dip buyers showed up.

The Nasdaq and Russell were the most oversold, so they went up the most today. Some of the most broken tech stocks had big short-covering rallies.

Some ideas

KWEB– Is China done going down? KWEB is the ETF with names like BABA, BIDU, and WB. All had 8-10% moves today. This one can be owned with a longer-term horizon with a stop around last week’s lows. Strong reversal Friday with a good follow through today.

MO– Bullish head and shoulder pattern developing. 51.00-51.50 would be the breakout.

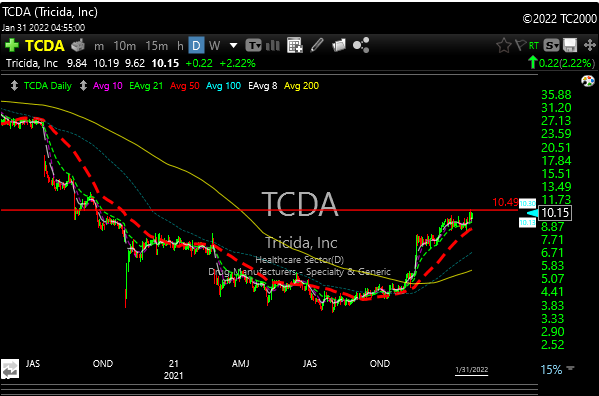

TCDA– Really nice base on this one. Watch the 10.50 level for a breakout.

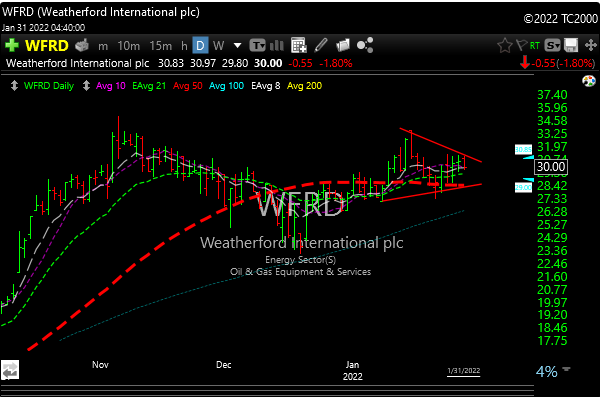

WFRD– Good looking energy name with a nice base. Watch the 31 level for a move to new highs.