Dow: -66.77…

Nasdaq: -315.83… S&P: -53.68…

The S&P 500 fell 1.2% on Tuesday in another volatile session. The benchmark index was down as much as 2.8% in the morning, then briefly peaked above its flat line in the afternoon. Growth stocks paced today’s decline and accounted for the underperformance of the Nasdaq (-2.3%).

The Dow (-0.2%) was unable to hold onto a late gain and closed slightly lower. The Russell 2000 fell 1.5%.

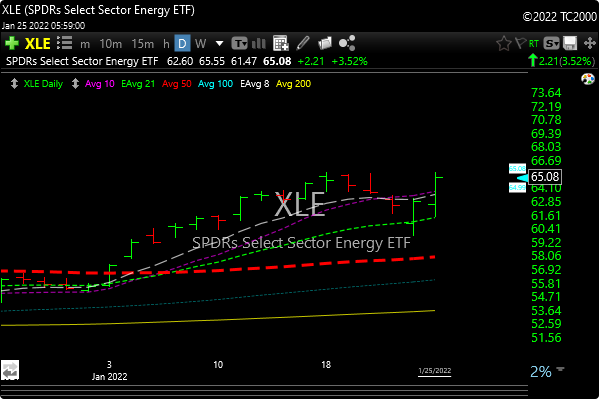

From a sector perspective, the information technology (-2.3%), communication services (-2.2%), and consumer discretionary (-1.8%) sectors underperformed with steep losses. Conversely, the energy (+4.0%) and financials (+0.5%) sectors were the only sectors that closed higher amid higher oil prices ($85.37, +2.06, +2.5%) and Treasury yields.

The early weakness was symptomatic of the recent tendency to sell into any indication of strength (yesterday’s specifically), which raised concerns about Monday’s comeback being a potential head fake.

The Russell is in a “bear market”, a bear market is loosely defined as a correction of 20% or more, and the Nasdaq is close.

MSFT was down 6.0% in aftermarket after earnings but is now almost flat. FFIV -12.0% after earnings.

During this market period, unless your numbers are perfect, a company will be eviscerated. No patience, no sympathy. Tech will get shot.

A very big Fed day tomorrow. We could see a blistering rally or an implosion. How’s that for direction?

Gun to my head, I think the bears have made their point, maybe time for a countertrend bounce. But not sure how long it will last when we get it.

See you in the morning.