Dow: +99.13…

Nasdaq: +86.21… S&P: +12.19…

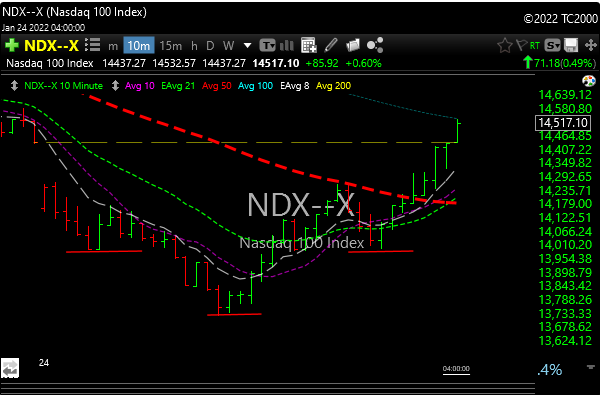

Gap down, hard selloff, bottom at around lunchtime, then rally. Notice the bullish inverse head and shoulders on the 10-minute chart. All the indexes looked just like this one today.

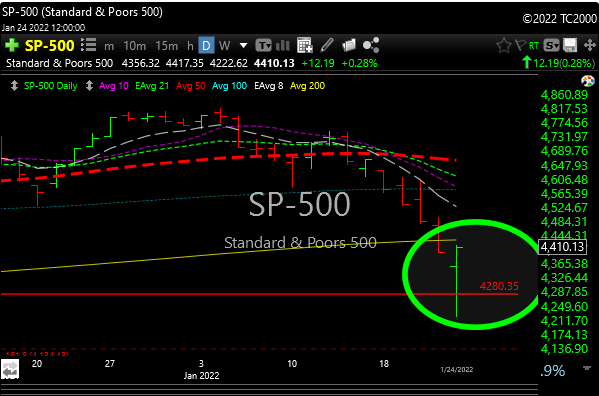

The S&P 500 increased 0.3% on Monday in a furious buy-the-dip trade after being down as much as 4.0% intraday. The Nasdaq gained 0.6% after being down 4.9% intraday, and the Dow gained 0.3% after being down 3.3% intraday.

The Russell 2000 outperformed with a 2.3% gain after being down as much as 2.8%. The small-cap index traded in bear market territory today, or down at least 20% from a recent high, so its outperformance stemmed from the fact that it was hit the hardest.

Eight of the 11 S&P 500 sectors closed higher after all 11 traded with steep losses.

One big reversal day doesn’t mean we are out of the woods, but a good start.

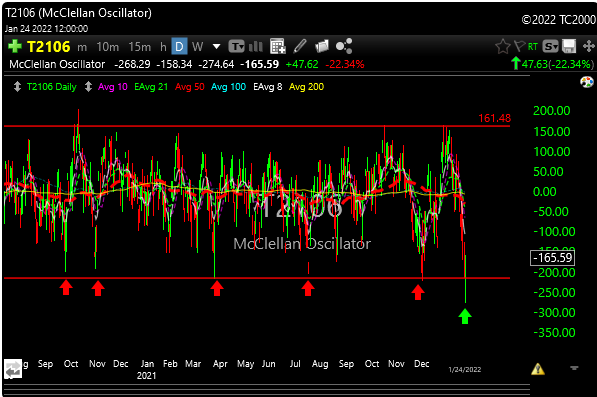

I normally don’t buy on the first day of a reversal but I saw McClellan Oscillator screaming at me to buy a little so I added TQQQ and UPRO. The latter is a re-enrty from the round trip stop out. 59 to 79 then back again.

All of the indexes put in spectacular reversal bars today. See an example of Nazzy below.

McClellan Oscillator overshot support today (happens a lot), then reversed. This has been money over the years and has been great at calling reversals.

I talked about the leverage long etf’s last night. The bottom-to-top moves in these things were crazy today, but of course, you’re trying to pick a bottom. TNA for example popped $10 off today’s bottom. SOXL, TQQQ, UPRO, DDM also reversed and ripped ‘bigly’.

The market has been crushed, and there’s a lot of reconstructive surgery that needs to be done. All the indexes are under their 200-day moving averages. That can be a good thing because if this is the start of a countertrend rally that can last for a bit then there will be some good opportunities.

Hopefully, this dumpster fire can give us a break to catch our breath and regroup.

Much of today’s rally was due to aggressive short-covering and the idea that things just got overdone.

The market usually overshoots to the upside and the downside.

I think we can scratch COVID from the ‘big things to worry about’ list. We still want to nation save Ukraine and that can be a problem short term.

Rates need to behave and hopefully, the Fed won’t blow up the world when they speak on Wednesday.

Was today capitulation? Kinda felt like it.

P&L here