Dow: -339.82…

Nasdaq: -166.64… S&P: -44.35…

YTD

Dow -3.6% YTD

S&P 500 -4.9% YTD

Russell 2000 -8.1% YTD

Nasdaq -8.3% YTD

The S&P 500 fell 1.0% on Wednesday, fading an early 0.8% gain despite encouraging earnings news and a decline in interest rates. The Nasdaq (-1.2%) and Dow (-1.0%) performed comparably to the benchmark index, while the Russell 2000 lagged with a 1.6% decline.

Nine of the 11 S&P 500 sectors closed lower, as selling interest accelerated into the close on no specific news.

The consumer discretionary (-1.8%), financials (-1.7%), and information technology (-1.4%) sectors led the retreat, while the consumer staples (+0.7%) and utilities (+0.5%) sectors closed higher.

So are there any green shoots or silver linings right now? Personally, I think the country is going down the sinkhole, but the market isn’t always the economy and we tend to climb walls of worry.

Is this time different? Is the market done, or are we just seeing a long overdue and healthy pullback?

Let’s look at some support, and we are close….if it holds. We are oversold on some metrics but not others. I’ve seen more oversold. I’ve also seen strong rallies from these types of levels.

Nasdaq

Almost touching 200-day moving average support. An overthrow of that level could suck in some shorts (bear trap) and start a countertrend rally.

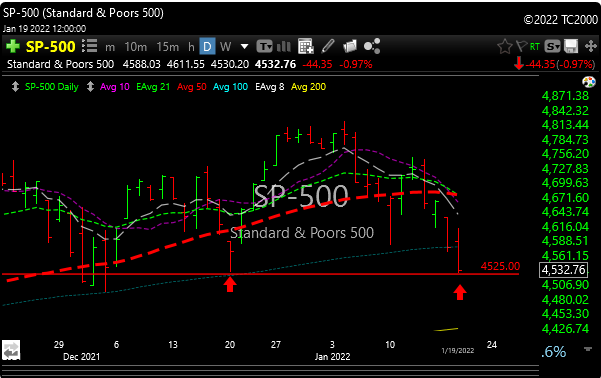

SPX

If you like double bottoms, the SPXis giving us one. This is a huge spot.

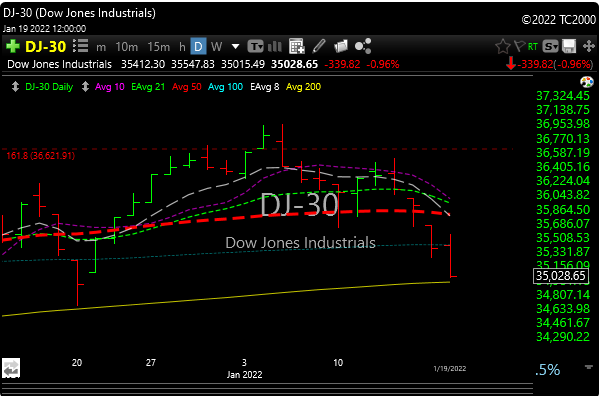

Dow Jones

Kissing the 200-day ma. It rallied furiously the last time it hit it back on December 20.

Russell 2000

So hard to sugar coat this one. IWM has broken very key support. Is this an overthrow of that support ( it happens) only to rally hard to the upside? Tough to catch a knife here. I’d feel way better paying up once I see that the bottom is in.

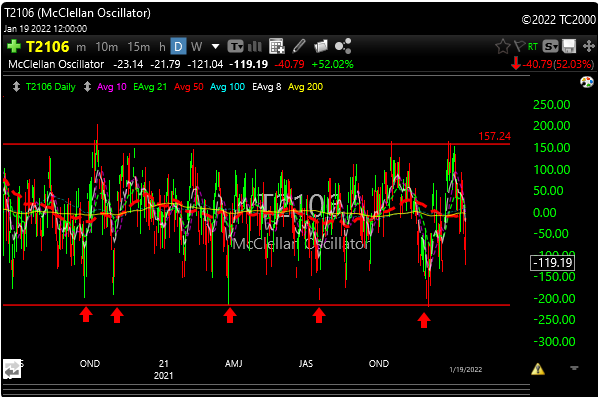

McClellan Oscillator

You’ve seen my favorite overbought/oversold indicator many times before. The red arrows are where you want to buy the market, and we are getting close. A flush down at the open would get us there, but it’s never that easy. I love the -200 zone to lay in longs.

Financials (XLF) got whacked again (rates down ticking/ opinion last night)). Energy (XLE) still looks very good but some profit-taking.

Last night I talked about gold and silver possibly waking up. Today they exploded (wish I did an anticipatory breakout trade ), but have been faked too many times on the metals.

I also hate to chase first-day breakouts as they can sometimes be big head fakes.

I will say though, that the technicals are strong and the volume was very significant today. As I mentioned last night, I play those trades via long AGQ, SILJ, and SIL. Let’s watch tomorrow, maybe we nibble if we get a pullback. If you bought this morning you are a genius and congrats.

Right now there are bear markets in some sectors, meaning 20% pullbacks. Other sectors are trying for highs, XLE, XME etc.

This is the big rotation.

Does it last? Do they go back to technology hard? Hedge funds have a herd mentality and they do what they do until it all flushes out. They detest all things tech right now. Reality.

We are close to a stop on MDRX ( a group that is now getting sold) and although BTU came down today, I’m bullish on energy until proven otherwise.

I’m seeing some of the ugliest charts since the beginning of Covid, but everything has a buy price. I think we are close to a reversal, but I’m definitely not as bullish as I was a year ago, and buying dips definitely doesn’t get me as excited. Broken charts will be shorts on bounces.

The rally will be good though.

Hang in there, see you in the morning.