Dow: -543.34…

Nasdaq: -386.86… S&P: -85.74…

The S&P 500 fell 1.8% on Tuesday amid anxiety surrounding rising interest rates, as well as some concerns about corporate earnings. The Nasdaq (-2.6%) and Russell 2000 (-3.1%) suffered steeper losses while the Dow fell 1.5%.

Ten of the 11 S&P 500 sectors closed lower with losses ranging from 0.7% (real estate) to 2.5% (information technology). The energy sector (+0.4%) was the exception, extending its monthly gain to roughly 17%.

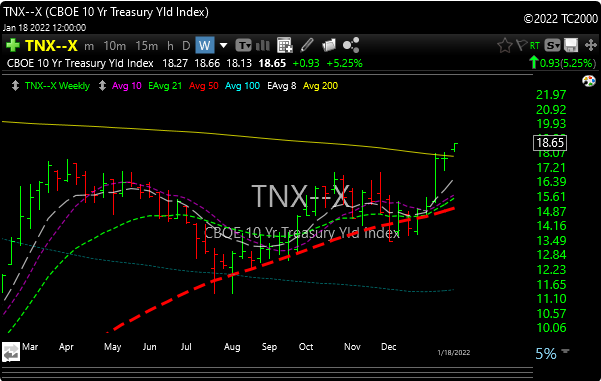

I talked about that 1–year treasury yield last night and how it was right at 200 dau moving average resistance on the weekly chart.

Today it broke above, so now we watch to see if the magnetic pull takes it to 2.0%. Big psychological level and I think much of it is being discounted already.

It doesn’t get much uglier than we what we’re seeing now in Nasdaq and Russell.

It’s also hard to believe that biotech (XBI) is down about 18% for the year and we’re just three weeks in. Talk about risk-off.

ARKK was down another 4% today. The shorts are smelling blood in that ETF and have been hitting it.

We may be nearing a tradeable bottom.

Nasdaq is just above 200-day moving average support so it could be a spot for an oversold bounce.

The energy sector (XLE) was the only green ETF today.

Financials (XLF) were down with rates up today, so that was kind of weird. Perhaps some are looking at a short-term top in rates so they sold down the financials ahead of that?

Some of the bank stocks looked like they had mini crashes today. Check the charts of GS, JPM today.

They say as January goes, so goes the year. So if you believe that, the bulls have a couple of weeks to get refocused and do some buying.

Still early, but I’m starting to glance at silver and gold out of the corner of my eye. It’s been dead and no one is talking about it. Keep you posted on that, but the charts are improving slightly.

Silver is back above 50-day ma. If I end up playing it, as usual, I will do it with AGQ and SILJ, but still early I think.

I added SLCA (chart posted last night) today and took a little off OXY on the pop.

Please check P&L for adjusted stops here.