Dow: +45.86…

Nasdaq: -12.26… S&P: -2.07…

The S&P 500 declined 0.1% on Tuesday after starting with a 0.7% gain and finding resistance at its all-time highs from last month. The Dow (+0.1%) and Nasdaq (-0.1%) also closed little changed and off early highs, while the Russell 2000 rose 1.1%.

The strong start was fueled by first-of-the-month inflows and a news cycle that fed into the reopening optimism: better-than-expected manufacturing PMIs for May out of the U.S. and Europe, the OECD boosting its global growth forecasts for 2021 and 2022, OPEC+ commenting on strong oil demand, and reports highlighting solid activity in airports and movie theaters over the weekend.

OPEC talked their book and said they see more oil demand. Crude rose 2.5%.

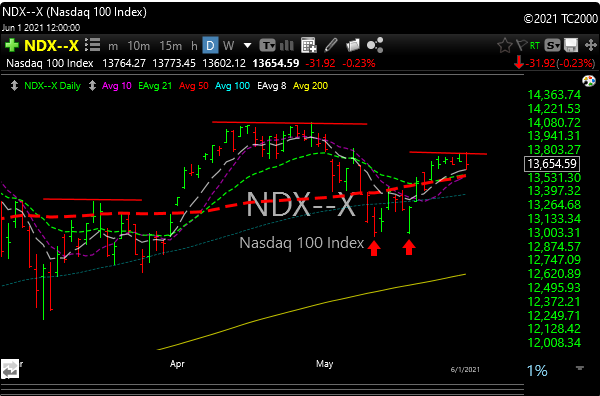

So I’m trying to figure out if that is the start of a right shoulder of a bearsh head and shoulder pattern for Nazzy in the chart below. Probably won’t confirm for a few days if it’s real, but bears watching. I’m also the guy when looking at an optical illusion sees Satan when others see a cute little puppy, so don’t trade off it yet.

Most of our stocks had a good day with the exception of CGC which followed the hooch stocks lower.

Keep your eye on SAVA. It’s coiling and if it resolves to the upside it could really run.

Meme stocks GME, AMC, EXPR, continued strong today.

I highlighted AHT as a watchlist name in the low 3’s a couple of weeks ago. It tagged 5 today, maybe take a little off if you bought it.

Biotech (XBI) still can’t get out of its own way. I watch it every day and I’m waiting for an opening, but it’s just not ready yet.

We rolled over to the June P&L.