Dow: -267.13…

Nasdaq: -75.41… S&P: -35.46…

It was a real slop fest in the market today. Head fakes, false starts, and failures. Tech is unloved again and maybe you could say they “sold the rip” that we saw on Friday.

It could just be all part of a choppy consolidation before we go higher yet again, but I’m keeping my powder dry just in case.

Energy, financials, and housing were all weak.

The S&P 500 fell 0.9%, as sellers first reined in the value/cyclical stocks then targeted the technology stocks late in the day. The Nasdaq declined 0.6%, the Dow declined 0.8% and the Russell 2000 declined 0.7%. Both the Nasdaq and Russell 2000 coughed up 0.8% intraday gains.

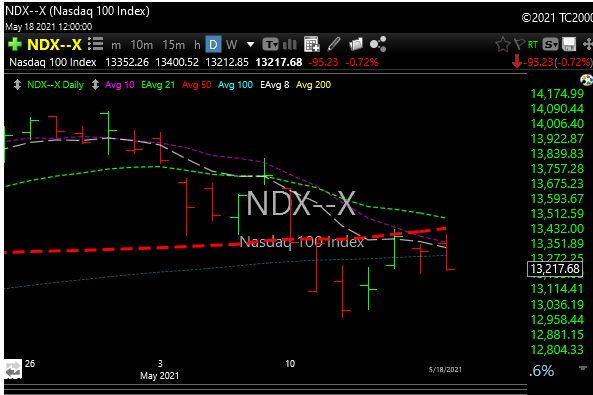

The Nazzy is having problems. As you can see in the chart below it keeps stalling at the 50-day moving average (red dotted line). That’s the kryptonite level for now. Bets should be light until it gets above that on a closing basis. That’s around the 13433 level.

If you were watching the market closely today you will see that the market broke down around 2:40 PM. It tried a little rally, but it was just a bear flag (yellow lines) and then it broke that flag hard to the downside in the last 10 minutes. This also happened to SPX, Dow, and Russell. Basically, the same charts.

15-minute chart

In those 10 minutes, the SPX lost 26 points, the Dow 200 points, and the Nazzy lost 100 points.

So a bearish close. There was no news, and all the indexes closed on their lows for the day.

I’m not sure what that portends for tomorrow, maybe nothing, but it wasn’t pretty.

See you in the morning.