Dow: -66.75…

Nasdaq: +146.10… S&P: +13.65…

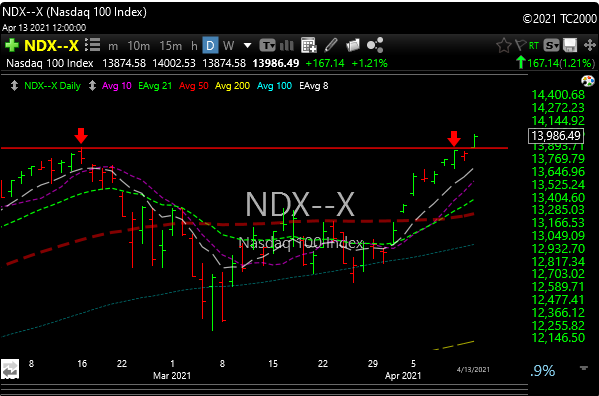

Nice double top breakout today

The S&P (+0.3%) set intraday and closing record highs today, even after the FDA and CDC recommended that states pause the use of Johnson & Johnson’s COVID-19 vaccine. Moderna had some positive news though. The mega-caps and growth stocks did the heavy lifting, as long-term interest rates moved lower following better-than-feared CPI data for March.

The Nasdaq outperformed with a 1.1% gain, while the Dow (-0.2%) and Russell 2000 (-0.2%) nearly recouped all of their intraday losses.

The Nazzy blew right through that double top (see last night’s chart) without a hitch. The Russell (possible head and shoulder pattern) was just flat today but rallied off the lows. The Russell is still a little sketchy here, needs a couple/few days up to invalidate that potentially bearish outcome.

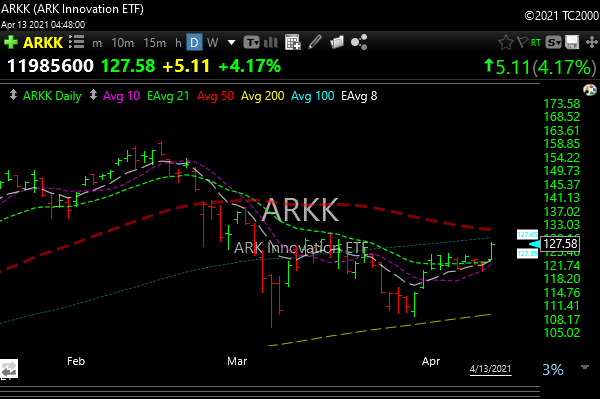

Speaking of the hot Nazzy, does it make sense to buy ARKK? It kind of “is” the Nazzy. Keep an eye on it.

Crypto/Bitcoin was hot today. RIOT had a great day, MARA did, then faded. Bitcoin did well, closing over $63,000.

Tomorrow (drum roll), CoinBase goes public. The “reference price” should be around $250 per share and will be listed on Nasdaq. Symbol: COIN.

I don’t care what analysts think, especially when it comes to crypto, but here you go. From Sanford Bernstein……..

“Coinbase is attractively positioned as a pure play leading crypto company, and a way to get crypto exposure for many investors who cannot own the underlying cryptocurrencies. On the other hand, the Crypto exchange/broker business is likely over-earning today with very high trading volumes, and relatively high fees – against a backdrop of intensifying competition. Acknowledging a wide array of outcomes, in our base scenario, we estimate ~90% rev and CAGR from 2019-23, but HSD revenue CAGR from 2021-25. We est. that revenue growth over the next 2-3yrs will largely be flat vs. likely elevated 2021 levels. In our base case DCF – we est. 30% compounded revenue growth from 2020-30 (and 10% from 2021- 31) and a valuation of ~$60-70B assuming 11% cost of equity”

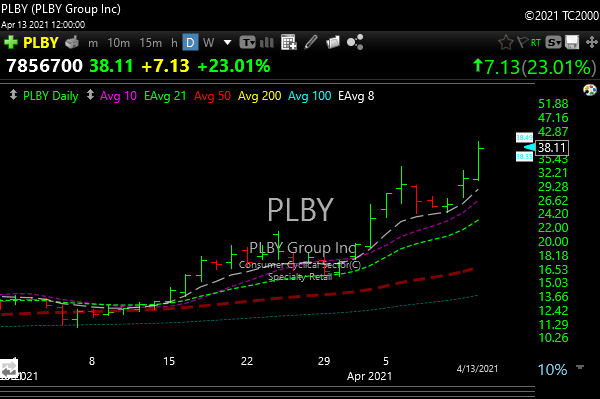

In the first 12 days of April only four SPACs have gone public vs. 41 in March and 28 in February. That’s healthy. And less supply. Have you seen Playboy? Yeah, it was a SPAC and they announced entry into NFT.

I don’t think I’ve played one SPAC. I guess I’m a late adopter or just a complete idiot. Maybe you old-timers can NFT your Miss January 1970 issue.

I added 2 new names today.

PLTR– This was a very hot stock that peaked in January 21. It has since dropped by half but has consolidated the beating and looks like it may be ready again. Good volume today and a breakout above some lateral resistance. Still has some work to do, but if it can get some momentum again I can see targets of 28.00, 30.00, and 31.00.

GNOG- The old Golden Nugget has morphed into Golden Nugget Online Gaming. This one has come down like PLTR. It has been consolidating in a falling wedge since January and is just under its 50 and 200-day moving average. A move above those moving averages accompanied by food volume can get this one going in the right direction. Can get going once through that 16.50 area.

The guys at Citron Research, who recently said they have sworn off shorting, (they so suck at it), put out an “informal” (very negative) report on RIOT today. Such nice guys, I guess they were doing a public service for all of us plebes.

Anyway, a “bot” caught a very large 1.6 million dollar put option trade, released 17 MINUTES before their informal report. Those options are down 50% and RIOT ripped higher. So they (or someone close to them) front ran their own idea and got burned. Maybe it was just a coincidence??????? Couldn’t happen to a nicer bunch of sleezebags.

Only the insider trading folks in Congress can grift like that.