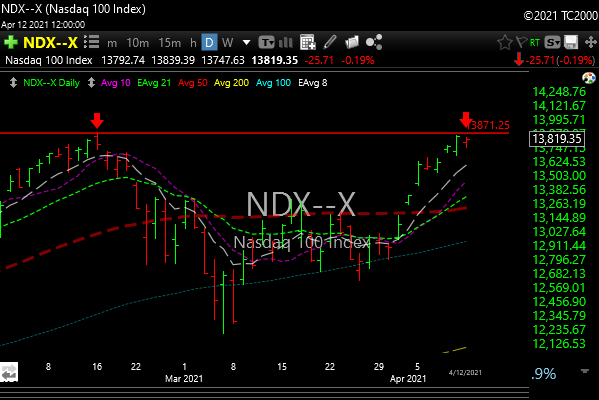

Double top on Nazzy, not negative, but at a huge spot.

Dow: -55.20…

Nasdaq: -50.19… S&P: -0.81…

Absolutely horrendous action today. Horrendous. They hit bids in some of the smaller growth names, tech growth specifically, as some stock came down pretty hard on no news.

We caught a stop on HIMX, and KOPN traded like it had brain rot. TIGR, which has great technicals and a great story started out well but then walked into the wood chipper.

The Russell is loaded with small-cap names and in looking at the chart I’m wondering if this may be the start of something that could result in lower prices.

It’s early, maybe days away, but the daily chart of the Russell ETF looks like it may be the start of a right shoulder of an overall bearish head and shoulder pattern. You non-technical folks care nary a with about this but I’m watching it closely. A few down days would confirm it.

SPX traded to a nominal new high near the close but ended just below all-time highs. It’s right at that important Fibonnachi level that I talked about yesterday. That could act as a kryptonite zone, but if it breaks above, we could get another leg higher.

The Nazzy was basically flat today and is holding right at all-time highs.

Earnings are coming hot and heavy and the bar is so ridiculously low that there should be some big “beats” which will help stocks. The stocks that miss will be taken out and shot.

Volumes down. Activity down. Chatter from sell-side / buy-side at Christmas-like lows. This is not the top.