Dow: +16.02…

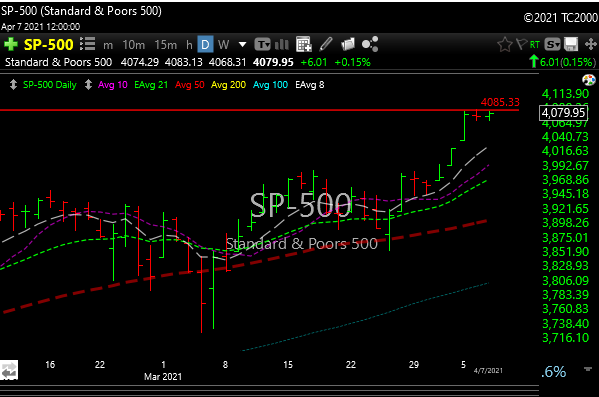

Nasdaq: -9.54… S&P: +6.01…

SPX mini bull flag at new resistance

The market was basically flat (exception Russell 2000), but it felt much worse to me and the rhythm seems off, maybe it’s just me. There is some good chop in this market right now but this sometimes happens when indexes are consolidating at new highs. Anyway, very frustrating.

Bitcoin and crypto are correcting so there is weakness in the MARA/RIOT type names again.

Biotech was weak today and looks like it may even want to go back down and retest that 200-day moving average for the fourth/fifth time, which is down at around 129. XBI closed the day at 132.

Biotech is “risk on” group, so its important that the sector stays glued together or it could pressure the Nasdaq.

KOPN had a very strong opening but started fading around the pre-lunch period. I saw this action with a lot of stocks today. Good open, then the fade.

15-minute chart below shows the fade after the strong open.

I added HIMX today which I highlighted over the weekend.

HIMX broke out of that wedge today, but like many others, it faded back. Anyway, the chart looks great and they had a great earnings report. Needs some real volume, but if we get it, we can see targets of 16.50-17.50.

AMKR (same sector) has an almost identical chart as HIMX and also looks much higher over time.

One to watch.

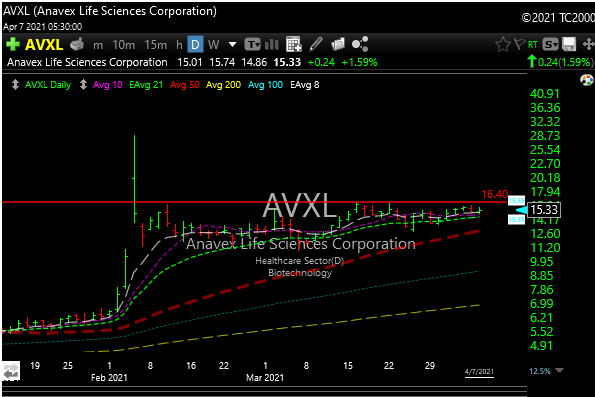

I mentioned AVXL (biotech) as a watchlist name over the weekend. It’s coiling bullishly after the massive high volume breakout which started back in early Feb. If it gets through the 16.40 level with “good” volume it can really take off.