Dow: +373.98…

Nasdaq: +225.49… S&P: +58.04…

The S&P (+1.4%) and Dow (+1.1%) rallied to fresh record highs on Monday, as the market keyed off strong employment and non-manufacturing data for March and positive momentum. The Nasdaq performed slightly better with a 1.7% gain, while the Russell 2000 increased just 0.5%.

Both growth and value stocks reacted positively today, but interestingly, it was the growth stocks that set the pace and the mega-caps that provided leadership. The S&P 500 information technology (+2.0%), communication services (+2.3%), and consumer discretionary (+2.3%) sectors, which contain the mega-caps, rose about 2%.

The energy sector (-2.4%), on the other hand, was a noticeable pocket of weakness and was the only sector that closed lower.

XLE is down about 10% recently, but still above its 50-day moving average.

Biotech has rallied 4 days in a row but is finding some resistance at its 21-day moving average. A move above that moving average with volume and things can get cooking again on the biotech front.

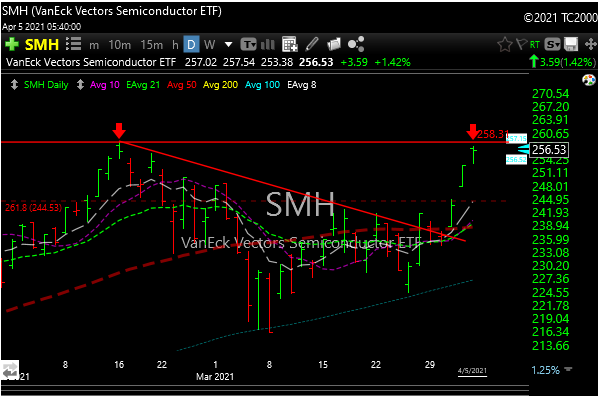

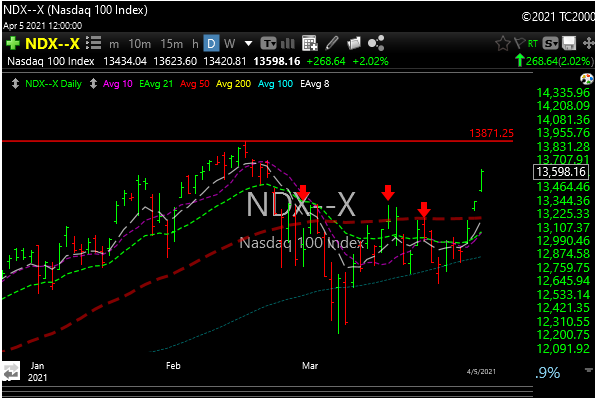

The Nazzy has come back with a vengeance. The SOX is up about 15% in 7 trading days and Nazzy has popped about 8-9% in just over a week. The Semiconductor Industry Association (SIA) today announced global semiconductor industry sales were $39.6 billion for the month of February 2021, an increase of 14.7% over the February 2020 total.

I talked about that bullish downtrend breakout on SMH last night. After today’s action, it closed right at a double top. It could fail here, but momentum feels and looks too good, so I say higher.

By the way, the FANNMG stocks looks MUCH better. Should they keep going it should take the market with them.

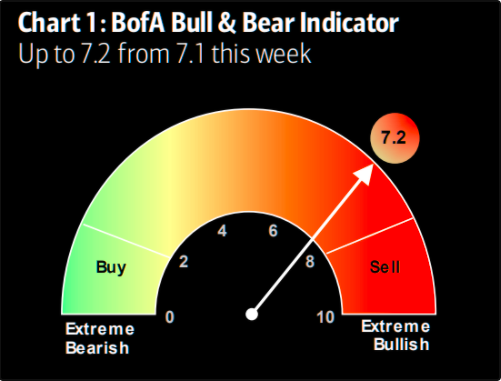

We are elevated on the sell-o-meter, but no sell signal yet, maybe its will just stay elevated while the SPX goes to 5000.

I had a 4080 short term SPX target, it tagged 4083 today and backed off to close at 4077. SPX could use a little consolidation, but next target is 4134.

Big day for Nazzy. Looks like the mid-Fed all-time highs are next. Through that? Maybe 15,000.

I’m watching gold and silver here. Still early, and the action has been dreadful, but seeing some signs. Developing.

For you uranium fans, CCJ and UUUU have great charts and are starting to breakout.

Hopefully, the EBON saga ends soon, maybe tomorrow. There has been some tomfoolery and skullduggery with that one as the trading around two secondary offerings within a week got a little weird. This stock has gone from around $6 to $13 twice over the last 5-6 weeks. When I recommend sub-$5-10 stocks (not often) I’m usually looking for 50% to a double or more, but sometimes they get crazy.

I’m still watching HIMX for a potential add. Some others that look good include:

CELH- Pullback play with greatly improving technicals.

CRTO- Coiling bullishly.

AVXL- 2 month bullish coil after massive breakout.

DBX- Mentioned over the weekend, getting momentum.

ERII- beautiful setup

GBOX- Breakout today, watch for continued momentum.

That’s half my watchlist but I’m adding more by the day. Keep you posted.