Friday Action

Dow: +453.40…

Nasdaq: +161.05… S&P: +65.02…

YTD

- Russell 2000 +12.5% YTD

- Dow Jones Industrial Average +8.1% YTD

- S&P 500 +5.8% YTD

- Nasdaq Composite +1.9% YTD

The S&P advanced 1.7% on Friday, thanks to a strong finish in the last hour of action. The Nasdaq gained 1.2% after briefly slipping lower in the afternoon. The Dow (+1.4%) and Russell 2000 (+1.8%) also gained more than 1.0%.

The gains were relatively broad, with ten of the 11 S&P sectors closing higher and eight rising more than 1.5%. The energy (+2.6%), information technology (+2.5%), materials (+2.5%), and real estate (+2.5%) sectors gained more than 2.0%, while the communication services sector (-0.3%) was the lone holdout.

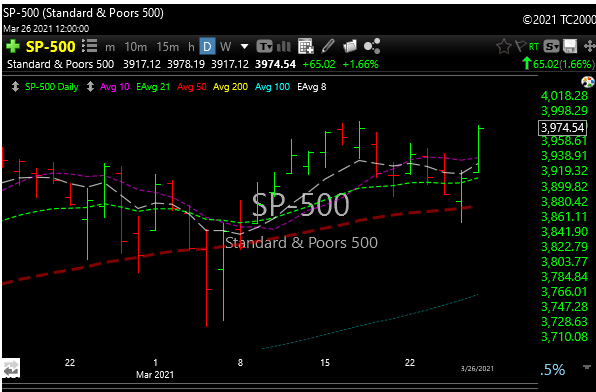

SPX

As long as the backtest at 3940-3920 holds, this targets 4000, 4040, then 4100. Warning though below 3920 = fake breakout and we selloff.

Chips

Semiconductor stocks (SMH) were a pocket of absolute strength on Friday, evident by the 5.0% gain in the Philadelphia Semiconductor Index (+5.0%). They helped provide the boost in the technology sector, which started the day unchanged.

Nazzy

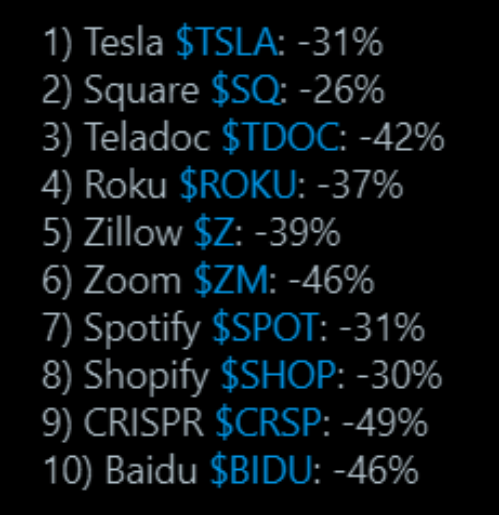

The Nazzy tried a sympathy bounce on Friday and it may be the start of something good, but tech (and biotech) have been taken out behind the barn and shot dead.

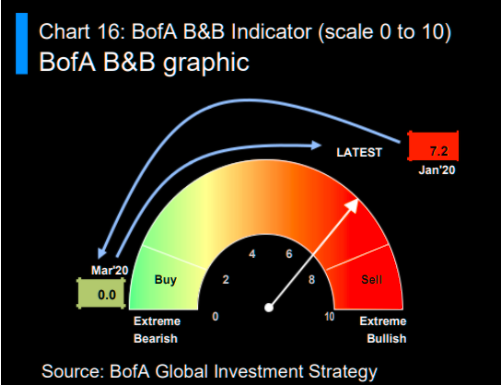

The BofA indicator has been accurate, its running hot but not at a sell signal yet.

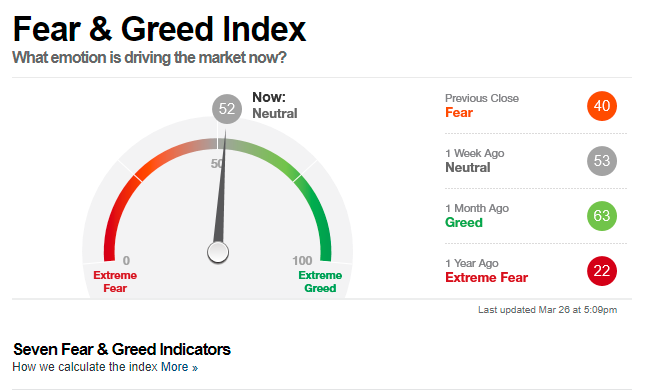

The Greed-O-Meter is still stuck firmly at neutral.

Treasuries

The surge in Treasury yields has been unrelenting. If rates can catch a break for more than a couple of days, then maybe bids will come back into stocks for more than just a couple of days.

FAANMG Stocks

Gone are the days of hot mega tech caps.

NYFANG index is trading back at the 100 day again. RSI is getting rather oversold.

Tempting for a bounce, but is that a huge head and shoulders formation staring at us?

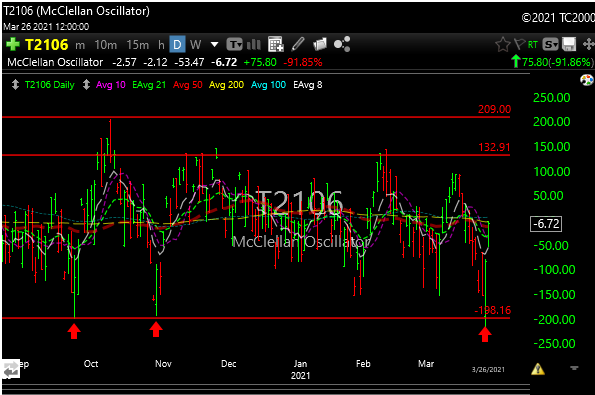

Oversold Enough? The McClellan Oscillator

My favorite overbought/oversold indicator hit a spot on Thursday that tells you start nibbling. Usually very accurate.

Was Last Year As Good As It Gets?

From CITI….“We doubt equity fund demand will continue to be as strong for the remainder of the year. First, an equity fund flow of $800bn for this year would be unprecedented in dollar terms.

Second, given last year’s return and last year’s flow, historical comparisons point to a more modest equity fund flow for 2021.

A simple historical regression of annual equity fund flows globally vs. previous year’s equity return and previous year’s equity fund flow points to less than $400bn equity fund demand for 2021″

One thing this guy may not be accounting for is buyback demand. You may remember the government (we are here to help), forbade companies from buying back their stock. That should resume full speed at some point soon.

My Takeaway

Maybe it feels like the selling is waning a bit. The market reversed up at 3PM EST, two days in a row.

It seems to be just playing into people’s fear of buying anything and thinking of what if….. That’s why it is so hard to be greedy when others are fearful sometimes.

With all the fear, and bitching, and moaning, the SPX still made new all-time highs on Friday, only by 40 cents, but still, a new high.

We caught a couple of stops last week which I felt were cruel and unnecessary, but it happens. The last few months have been ridiculously good for us so every once in a while we need to take a hit. It’s time to cowboy up and start looking for some ways to make some money again. Easy periods of the market precede difficult times which precede easier times. It’s the circle of life.

I still don’t know what Monday will bring, no one does, but my gut says that maybe the bears have had some short term fun and will get the hell out of the way.

The mother of all crashes will arrive at some point, just not yet.

Here’s some good cosmic news: NASA has given Earth the all-clear for the next century from a particularly menacing asteroid.

The space agency announced this week that new telescope observations have ruled out any chance of Apophis smacking Earth in 2068. We need to be thankful for the little things. I’m getting anxiety about 2069 already.

Also, a ship is stuck in the Suez Canal. I told them to make it wider. No one listens.

Here are some setups for your perusal for the upcoming week. Remember that not all stocks make the P&L because it would become too voluminous, but I do consider these worth a hard look, some may even make it to the P&L. Have a great weekend.

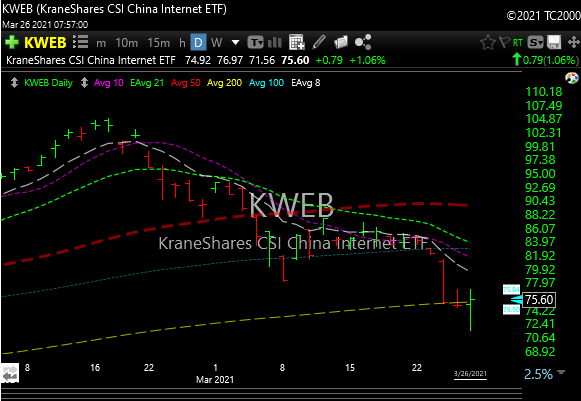

KWEB– Asian tech moving higher is a rare occurrence these days. Most big components are bouncing; Tencent +2.5%, JD +1.9%, Taiwan semis +2.5%, Meuituan +5.2% and yes, crappy BABA -2.2%. KWEB has had the stuffing knocked out of it and could be ready for a bounce. If China tech gets really hot, then it could really get a huge move in the weeks and months ahead.

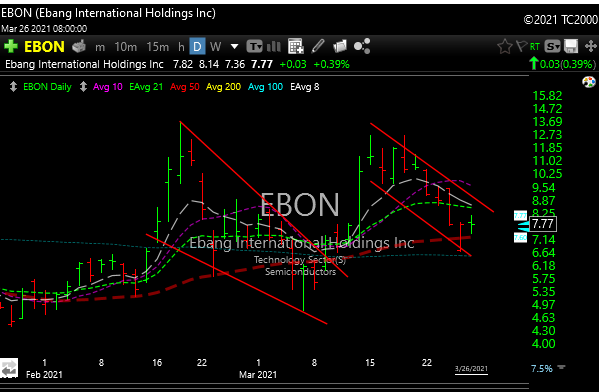

EBON– This was highlighted a few months back around $4. Did very well, especially recently, but it has pulled back the last couple of weeks with the other crypto names. It appears to be in a second falling (bull) wedge as you can see by the highlighted area. Crypto finally started to act a little better Thursday and Friday (still early), but if they get hot again, then EBON is worth a look for a move back to recent highs.

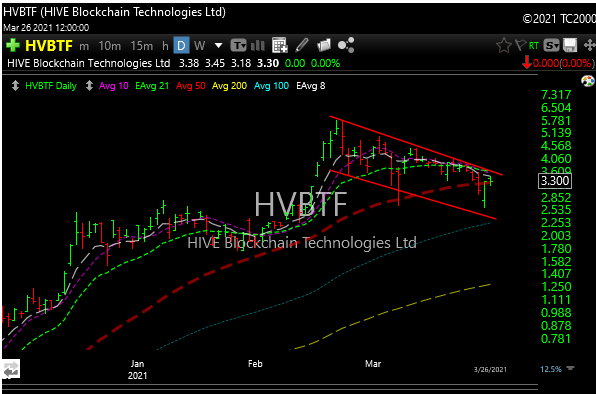

HVBTF– is a blockchain name that I have been watching for months now. It has a beautiful bull wedge and should resolve either way soon. If crypto resumes higher this one may too. It tagged $5.75 back in February. Could get rolling once through the 3.75-3.80 level. If you buy here you need a stop around 2.25-2.50.

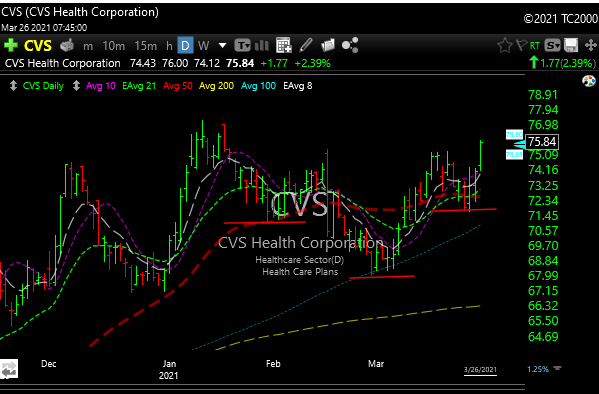

CVS-A less risky play, but a nice bullish head and shoulder pattern in the works. 77.60-82.00 would be targets.

Have a great weekend.