Dow: +199.42…

Nasdaq: +15.79… S&P: +20.38…

Not a whole lot to report today. Pretty boring.

Sometimes after a selloff we have seen you get a big +2.0% up day which still cant always be trusted.

Today the buyers seemed to be stepping in with a bit with caution, but maybe it’s better we grind out a slow bottom than do one of those patented V-shaped rips that ends up getting sold anyway.

The Russell 2000 rose 2.3% after finding support at the 2100 level, which represented an 8% decline in just over three sessions. Presumably, this was a short-term oversold condition that was primed for a bounce.

One sign that can put a positive spin in terms of “risk back on” would be the action in the meme stocks.

EXPR, GME, AMC, and KOSS all had very strong days. So speculation isn’t dead, its just taking a break.

Crypto was better today as Bitcoin bounced off the lows and MARA and RIOT looked better. EBON closed red but about 15% off the low of the day.

Maybe the most interesting to me was XBI, from a chart angle. That potential double bottom on the daily chart was staring at me all day so I added BIB which will give you 2X the move of XBI. I usually play LABU (3X) but I don’t trust anything enough so I went with BIB.

I suck at picking bottoms so I went with a half position in BIB instead of LABU with the idea of buying the other half if it dips five or six points. However, if it did bottom today, or is close to a bottom, BIB should rip. 92-95 would be targets if we get the wind at our back again.

I also added BBIG today as my little spec long play. There is some chatter it may go the NFT route, if that happens It could see a really nice pop. No guarantees, jus speculation, but good chart.

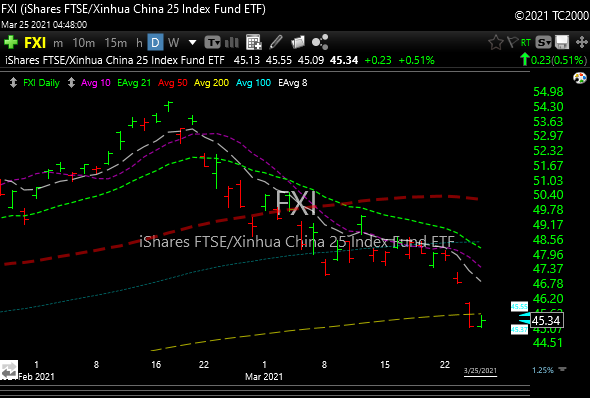

In other news, China has been getting eviscerated. Might be worth a look at some point soon. Also watch KWEB.

Staring to build an oversold list. Here are some names.

TIGR, PDD, EBON