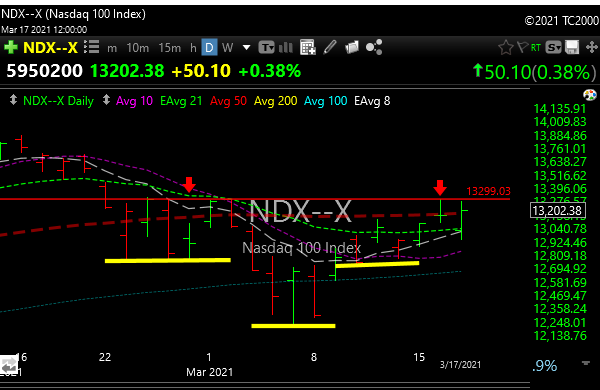

Nazzy at resistance but just slightly above its 50-day moving average.

The Fed chair struck an unmistakable dovish tone (zero rates forever?), which manifested itself in a rebound effort in the stock market and a decline in the U.S. Dollar Index. The 10-year treasury still poked higher by 1.0%. The takeaway was that the Fed will hold rates steady through 2023.

I try not to be too active on Fed day but today’s action was pretty good. I’ve taken the bait before on Fed day only to be punched in the face a day later. The setups will still be there.

All the wonky, always wrong economists will now be watching 2023 Eurodollar futures.

Things that you think may have “run too much” still have great charts. GBTC, MARA, RIOT, EXPR, AMC, and GME. Some of these names are the frothiest of the froth, but still have powerful charts for the most part.

I’m watching the dollar here. If it decides to implode again it could give new life to the metals which have been acting horribly. We have AGQ and GDX as silver and gold exposure.

I’m having chart problems tonight but here are some names that look bullish to me and I will add some color in the days ahead. Most are cheapies.

SINO, AHI, HVBTF, GNOG, ENG

New highs for the DOW and SPX, the Russell is close, and the Nazzy has some catching up to do.