Friday action…

Dow: -620.74…

Nasdaq: -266.46… S&P: -73.14…

YTD

- Russell 2000 +5.0% YTD

- Nasdaq Composite +1.4% YTD

- S&P 500 -1.1% YTD

- Dow Jones Industrial Average -2.0% YTD

The S&P 500 fell 1.9% on Friday, as the continuation of the short-squeeze mania wore out investors and fed into concerns about fund managers selling long positions to cover their shorts. The Nasdaq declined 2.0%, the Dow declined 2.0%, and the Russell 2000 declined 1.6%.

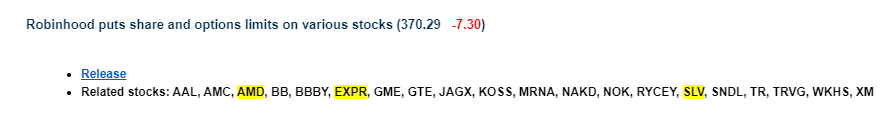

Brokerage firms, most notably Robinhood, eased some of the trading restrictions they temporarily placed on Thursday on heavily-shorted stocks like GameStop (GME 325.00, +131.40, +67.9%) and AMC Entertainment (AMC 13.26, +4.63, +53.7%). There were still limitations, though, which might have tempered the intraday rebound gains in these stocks.

Battle of the vaccines

Johnson & Johnson (JNJ 163.13, -6.03, -3.6%) said its single-dose vaccine candidate was 66% effective in protecting against COVID-19, and Novavax (NVAX 220.94, +86.93, +64.9%) said its vaccine candidate produced an 89.3% efficacy rate in its Phase 3 trial in the UK. NVAX shares rose 65%.

S&P

From a technical perspective, the S&P 500 closed just below its 50-day moving average (3716), which is a key technical level many traders watch for short-term purposes. All 11 S&P 500 sectors finished lower with losses ranging from 0.5% (utilities) to 3.4% (energy).

We shall see what the WallStBets subreddit will be up to this coming week. Over the past few days, this subreddit has seen an absolutely insane amount of growth. In the past week, subscribers have quadrupled, pageviews have surpassed 1 BILLION. Thats a lot of buying power.

They don’t have the power individually, but as a retail army, they can have substantial buying power. Robinhood and other brokerage firms have severely limited their share size, but my bet is that they will find an alternative soon to do their trading. I’ll talk about that in a minute.

Here is the current list of what the Robinhood platform will “allow” you to buy.

Let the class action suits begin……any day now.

Here is how the most shorted names have performed so far this year. Remember, “this year” is only 4 weeks. Now you know why hedge funds are so pissed.

The average US long/short hedge fund is now -2.8% YTD, with the bottom 10% group now -9% YTD. Not a disaster, and the industry has for sure climbed out of bigger holes than this, but stark difference to long-only.

The Robinhood accounts are essentially shut down. So where will they go? I’m sure there are some other platforms, but keep your eye on IPOE. You may know this as the student loan company, SoFi, but they do have a trading platform, and it’s run by Chamath Palihapitiya.

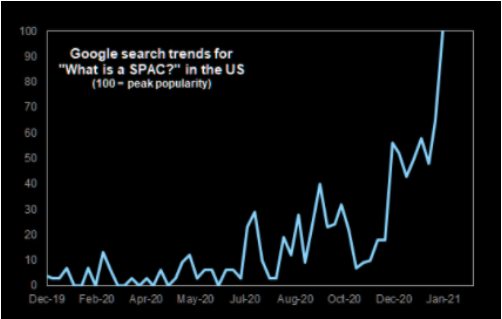

SoFi will be going public through IPOE which is a SPAC. Chamath has already told Robinhood users to switch platforms and he won’t restrict them. The chart looks good. It could get interesting.

Chamath is becoming the SPAC king. He is also doing, IPOD, IPOF, and IPOZ. All will be underwritten by Credit Suisse.

A SPAC is a “specialty purpose acquisition company”. Back in the day they called these things “blank check” shell companies.

History may not repeat, but it often rhymes. Same thing…..different names. Kinda’ like how global warming is now climate change.

Every possible speculative signal is telling us the market is ready to get a waffle iron to the face. Reddit, SPAC’s etc. Unbridled enthusiasm to the max.

The market was very jittery on Wednesday and Friday as you know. So be careful out there.

So naturally, everyone who is late to the game wants to know what stock or sector will be next to run via a short squeeze.

Silver?

The Reddit bros were talking about “cornering the market” on silver late last week. Look what silver did on Thursday and Friday. I honestly have to give these guys credit, if nothing else, it’s entertaining. The volume was ennormous.

Want proof?

14% of silver investment supply was bought in 1 day last week. Most in the silver markets have been waiting since 1979 for someone like the Hunts to massacre the “Short Sellers” that have been suppressing #silver & #gold to keep the psychological impact of money printing invisible. This could get very interesting if it gets legs.

SLV took in almost a BILLION dollars Friday, nearly double the old record for this 15-yr old ETF, after being targeted by WSB (Wallstbets) as a way to go after the banks

. Here is an interesting piece by Zerohedge on the whole thing.

I am rooting for a squeeze in silver. We are long AGQ which gives you 2X the move in silver. I believe JPM is the bank that is ridiculously short silver. I’d love to Jamie Dimon get squeezed like a beefsteak tomato.

I’ve said many times here that I think silver will outperform gold. I’m still not a true believer that these Reddit characters will get a unified force to squeeze silver, but the action on Thursday and Friday was pretty interesting and makes you pay attention.

For months I have told you my favorites in the space. SIL (silver miners) SILJ (junior silver miners) and of course, AGQ, which is 2X SLV.

On the gold front I still like GDX, GDXJ.

AG is a silver stock that had a big short position. Check out the action Thursday and Friday.

Silver is practically back to early Jan highs, extending the move on Friday. Gold on the other hand, remains soggy, but is showing signs of life.

We are in a market here that cares nary a wit about fundamentals or technical analysis. Greed and following momentum rule the day. That’s ok, just know when to fold ’em.

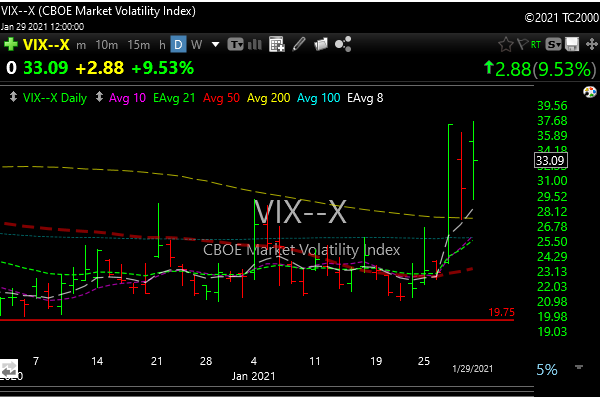

The VIX

The volatility index caught a 40% move last week so fear is back in the building, at least for now.

If we don’t flush lower on Monday it wouldn’t surprise me at all to see an oversold bounce higher as we got a little short-term oversold. The dip buyers have been insatiable, so they may start bidding things up again as early as tomorrow.

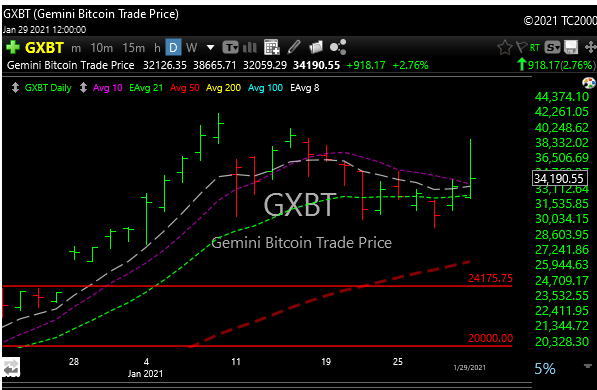

Bitcoin

Had a better week and may be done going down for now. MARA, RIOT also look better. The one thing that worries me about Bitcoin now, and I mentioned it last week, is regulation. Governments have ZERO incentive to allow private coins like Bitcoin to dominate and threaten their control of the FIAT currency system. They will never let anyone or anything threaten their power and control. They are silly like that.

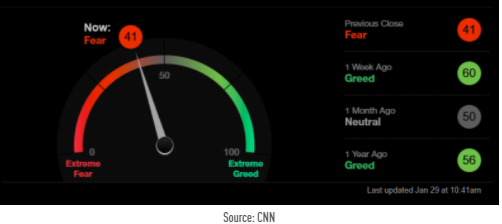

Greed-O-Meter

I showed the meter last weekend. I think we were at 7.2. We closed this week at 4.1. So we have gone from extreme greed to fear in a week.

You can make the case that this market is bubbleicious and eerily similar to what we saw before the tech bubble crash in 2000. I’ve traded through four market crashes starting in 87 if you include that adorable flash crash of a few years ago. They can have similar characteristics and warning signs.

Probably the biggest warning to me right now is what we are seeing with the Reddit bros, very similar to the AOL chatrooms in 1999.

We will see, but gun to my head, the bulls still run the show.

I’m reluctant to put out too many long ideas here considering last week’s volatility, but here are a few to watch. I will let you know if I add any.

FPRX- You may remember this was highlighted a couple of times back in November. It went ballistic to the upside, about 400%. I’ve been watching it since that big breakout and as you can see in the chart below it’s been consolidating bullishly ever since. Very orderly. I like this bullish coil and as they say, the longer the base, the bigger the chase. If long, you MUST have a stop around the $13 level because if it breaks that it could go down and try and fill that breakaway gap and that could be ugly. Right now it’s sitting right under the 50-day moving average (red line).

CLVS– has broken my heart more than I want to discuss, but we saw a big downtrend breakout recently, and there’s a big short position.

JE– was highlighted last week. It ran, but has pulled back on lighter volume and is flagging.

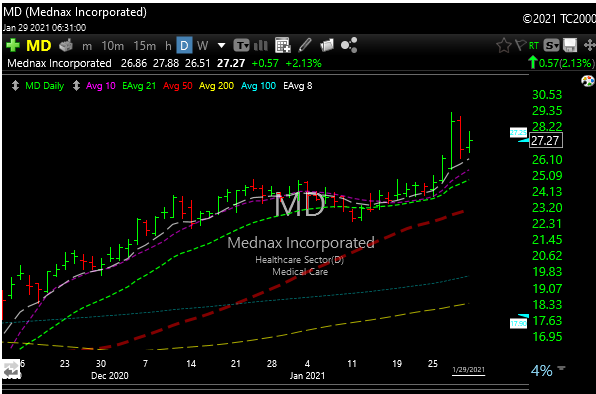

MD– Nice flag with a decent short position.

By the end of the week, the Fed may be looking for an expert in trillion-dollar hedge fund bailouts to prevent the collapse of the banking system.

Its all fun and games until someone gets poked in the eye. If you had a bad month, don’t feel bad. Melvin Capital was down 53% in January.

Current P&L here