Dow: -200.94…

Nasdaq: +65.40… S&P: -7.66…

The stock market ended Tuesday on a mixed note, as the S&P 500 (-0.2%) and Dow (-0.7%) finished in the red while the Nasdaq (+0.5%) and Russell 2000 (+1.0%) outperformed.

We traded in a narrow range today, keeping the S&P near its flat line throughout the day. Nine out of eleven sectors finished in negative territory, but their losses were largely offset by relative strength in the technology.

The market was red and a bit sloppy but some of our names saw decent action.

MTEM finally woke up and popped +10.0%.

JMIA, which has been awesome, added to recent gains today and was +14.4%

PRTY popped almost 6.0%.

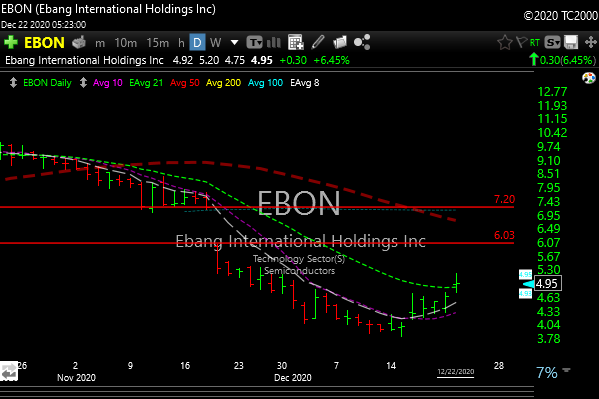

EBON, which I highlighted the other day around 4.50 popped 6.25%. You may remember this was the small crypto play that I highlighted. If momentum kicks in we could see 6-7 short term.

Last week saw the largest buying of equities since March from BoAM clients (private and institutional). Strangely enough, prior to that week, the equity flow had been negative YTD – and private client flow still is. This is far from a complete “flow picture” for the overall market, but it is at least a small data point that there is potential for more buying going into 2021 from some pockets out there.