Dow: +337.76…

Nasdaq: +155.02… S&P: +47.13…

The large-cap indices advanced more than 1.0% on Tuesday, predominately due to the influence of AAPL, +5.0% and renewed stimulus optimism. The Russell 2000 closed at a record high with a 2.4% gain, followed by the S&P 500 (+1.3%), Nasdaq (+1.3%), and Dow (+1.1%).

Early in the day, Apple was the main driver of things after the Nikkei reported that the company plans to increase iPhone production by 30% yr/yr in the first half of 2021. With a $2.17 trillion market capitalization, the stock’s 5% appreciation was an undeniable force for the major indices.

The energy (+1.9%), materials (+1.9%), and financials (+1.7%) sectors were among the biggest gainers in the S&P, which happened to snap a four-session losing streak today.

M&A a driver……

Following up on a very strong Q3, Q4 now looks like it will be even bigger which would make it the biggest M&A quarter in a very long time.

Yet another piece of the puzzle for the absolute craziest of bull market melt-up tops in the making is this brewing “merger mania”. This week we have had a flurry of deals ($60bn and counting). Huntington and TCF announcing plans for an all-stock merger valued at $22 billion, AstraZeneca to buy Alexion for $39 billion and EA for Codemasters for $1,2bn are the highest profile. Looking below the surface Monday also saw a number of mid-market regional transactions in Europe which included both LBOs and hostiles.

In terms of global M&A volumes as a percentage of US GDP, we are still only in-line with the trailing five-year average (20%). Volumes as a percentage of GDP rose as high as 23% of GDP in 2015, suggesting there’s more room to go in a rising market. The pandemic has accelerated secular trends, driving more businesses to consider strategic options. Sponsors also have a significant amount of dry powder to put to use in an improving economy. Not to mention the SPACs.

Positive news on a vaccine, CEO confidence, and record amounts of debt-raising that have built corporate cash buffer and stock prices going up on deal announcements – it all looks that all stars are aligned for “mega-merger mania”. Not only are the fundamental stars aligned – it is actually happening – given the very strong autumn months it looks like 2H20 has a decent chance to be the strongest M&A period in over 10 years. And, add to that the fact that US M&A volumes as a % of total US equity market cap is well below the historical averages. This will go back to at least the average.

I backed off RVP today (shouldn’t have). It popped 20%. I got a lot of emails from you guys that you took it. I can’t put every name on the P&L, it would get too voluminous, but I try to generate actionable ideas for you. PRLD has run 20 points, it was a Sunday highlight name two weeks ago. If it’s not on P&L and you want some color on a name, just email me. FPRX ran 300%, it was highlighted twice 5-6 weeks back.

The top four airlines pissed away $45 billion in stock buybacks since 2102, but they will get another $17 billion taxpayer-funded bailout if the $748 billion “bipartisan” stimulus proposal that the four most senior Congressional leaders are discussing this afternoon makes it into law.

Enjoy your flight.

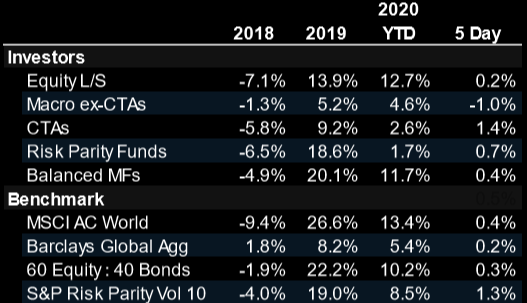

Meanwhile, hedge funds of the long/short variety are underperforming the benchmark once again. Most of you are beating them in your sleep and you don’t charge 2 & 20.

I added two new names today, ABUS and JMIA.

See you in the morning.