Dow: +37.90…

Nasdaq: +111.44… S&P: +8.70…

- Nasdaq Composite +36.0% YTD

- S&P 500 +12.6% YTD

- Russell 2000 +11.2% YTD

- Dow Jones Industrial Average +4.8% YTD

The S&P 500 (+0.2%) and Nasdaq (+0.9%) closed at fresh record highs on Friday in a shortened trading session. The Russell 2000 increased by 0.6%, and the Dow increased by 0.1%.

The price action in the S&P 500 generally lacked conviction given the reduced market participation, although trading volume at the Nasdaq was three times higher on Friday than the same time last year. In addition, the market never got the risk-on signal from the Treasury market, which traded higher throughout the morning.

The market is generally on cruise control right now with nary a worry about the downside.

The VIX and VXN (Nasdaq VIX) are imploding, no one is long any puts and call options are being gobbled up. Fear has left the building and complacency reigns.

We talked about Thanksgiving week having a bullish bent and it didn’t fail to impress. The SPX picked up about 60 points in 3.5 trading days last week.

If momentum continues we could see SPX 3665 and 3750 as next targets.

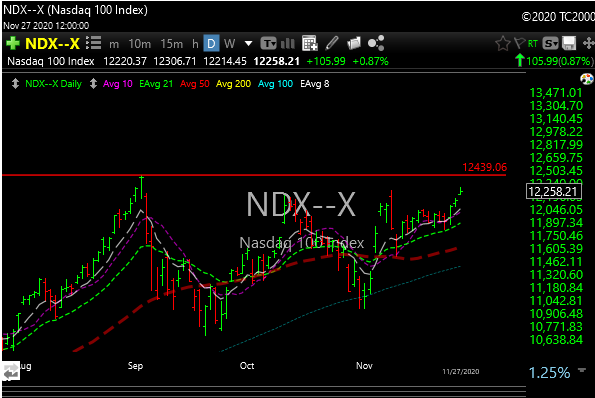

The Nasdaq, which took a little vacation recently looks to be perking up again. We saw a rotation from tech to financials (XLF) and energy (XLE), but it looks like the Nazzy may want to resume the upside as chips (SMH), internet (FBN), infotech, (VGT), and software (IGV) all looked bullish last week. My four horsemen of tech.

Some are calling for a violent upside rally in Nasdaq into year-end, I don’t doubt it.

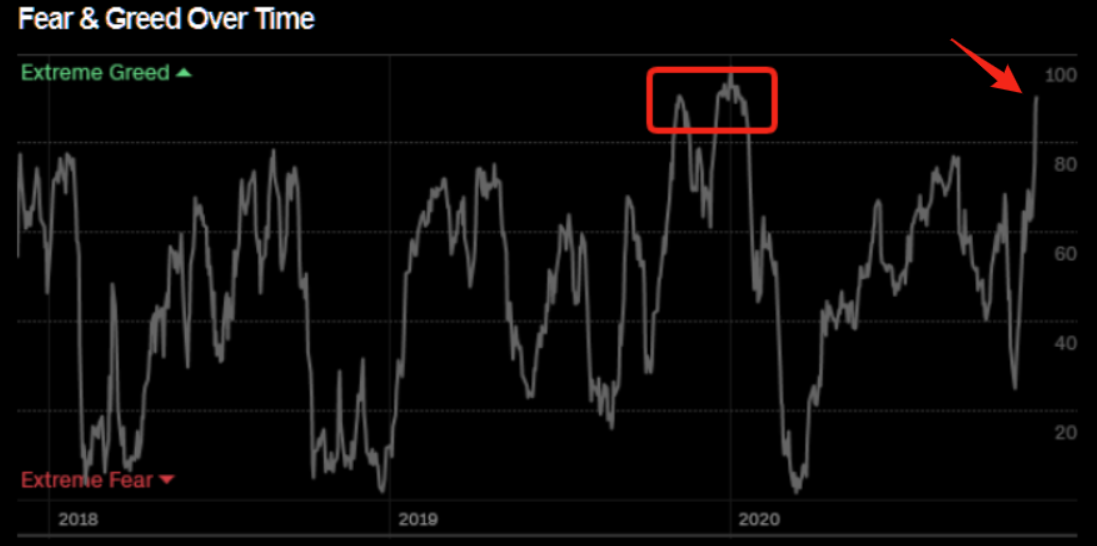

Sentiment

We are getting a tad piggish on the greed-o-meter right now and this is a pretty high reading. You guys know we post this all the time.

Here’s the put/call ratio. No one wants no stinkin’ puts.

Exposures

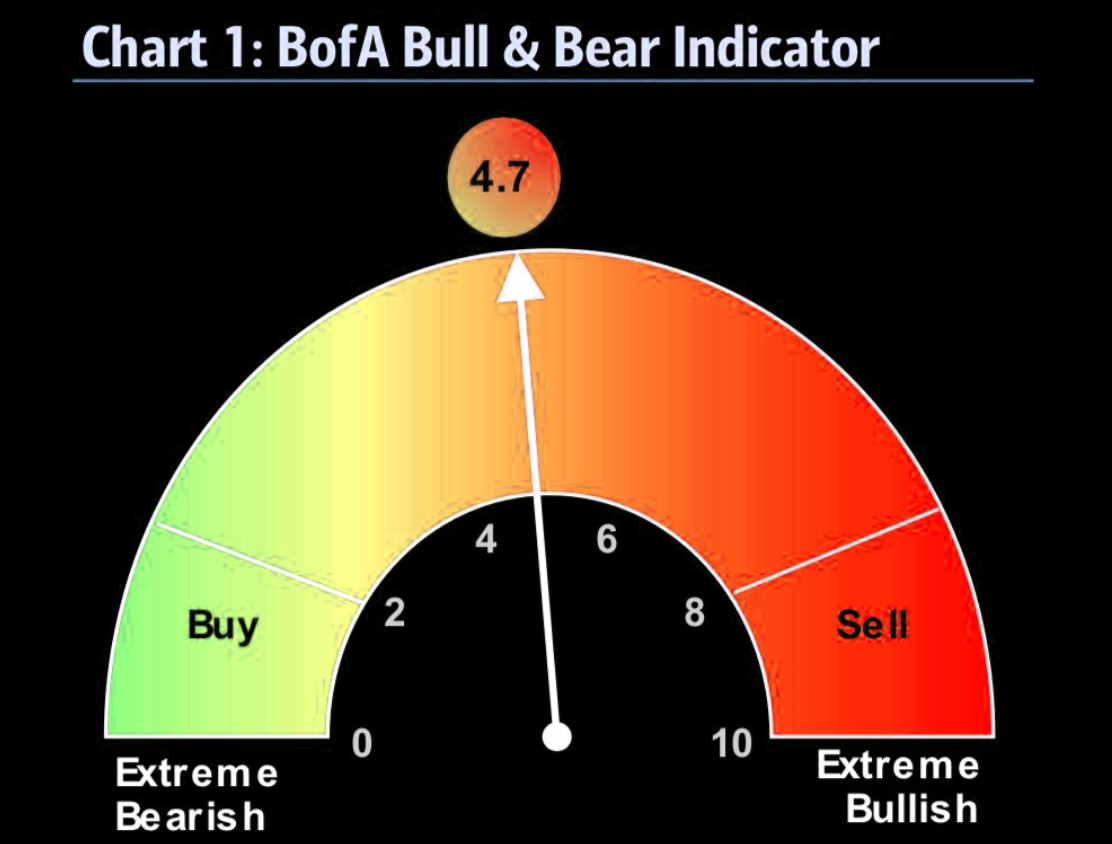

I have noted for weeks now that hedge funds are “all in”.

In the US, HFs have now been reducing gross exposure for 2 straight weeks.

2. most of the reductions on the long and short side since last Friday coming from Equity Long/Short and Stat Arb / Quant funds.

3. Even with the recent de-grossing, net exposure globally remains very elevated – US 59% (95th percentile, 93rd percentile since 2010), EU 52% (100th percentile, 97th percentile since 2010), and Asia 67% (95th percentile).

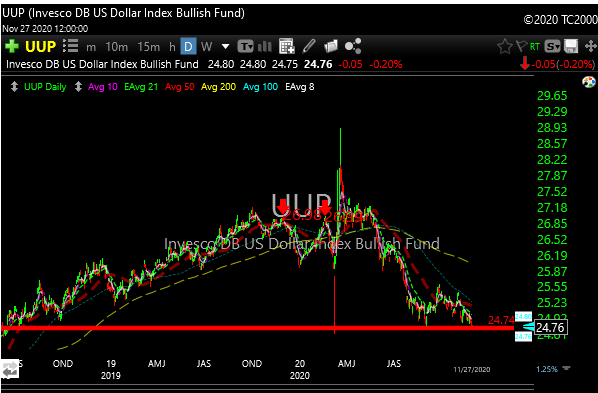

The Dollar & the Metals

Meanwhile, the greenback is sitting on one of the most important “fish or cut bait” spots in a long time. This is the spot where it’s either going to breakdown hard or start a counter-trend rally to the upside. If the latter happens, gold and silver will see more pressure, if it breaks lower, then the metal party should start up again.

Interesting that the gold and silver “miners” were mostly green on Friday, while gold and silver were down, Could be a bullish sign as the miners can sometimes lead the move in the actual commodity. Stay tuned.

Gold has not been this oversold since the third quarter of 2018. Bulls need to recapture $1800 gold next week.

It looks like our favorite economic lawn gnome is back as Janet Yellen bellies up to the bar.

Inflows have been good.

BofA notes, over past three weeks;

1 record inflow to equities – $89.0bn

2 record inflow to EM debt & equity – $28.0bn

3 value sees second largest inflow ever – $7.6bn

4 small cap – fourth largest inflow ever – $9.9bn

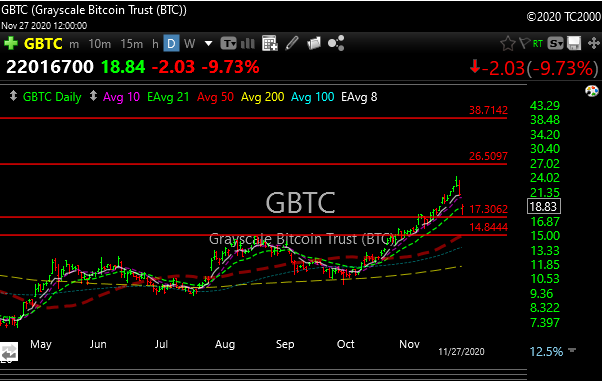

Bitcoin

Bitcoin caught at reality check last week. After breaking out and tagging the $19,500 zone, it pulled back and closed the week around $17,084.

The bitcoin etf pulled back from the 24 zone to around 19 last week.

The long-term chart of GBTC is still bullish, but you will get hit in the face with a hammer from time to time when you own this one.

Watchlist

We had a very solid week last week, here are some watchlist names for the coming week.

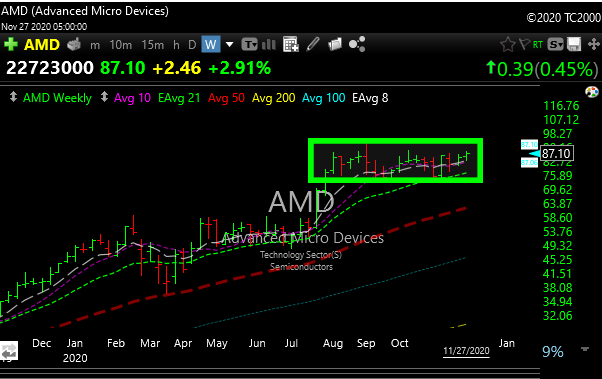

AMD – is trading in a very tight and bullish range. Targets 95-105

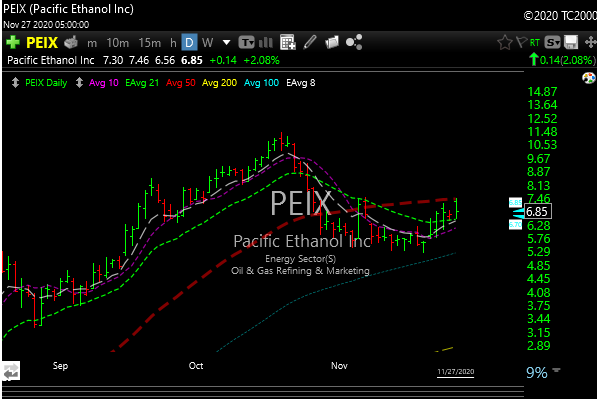

PEIX– we had a terrific trade on this one a few weeks back. It then broke down, priced a secondary, but now it looks like it’s rebuilding its base. It’s also right back at its 50-day moving average. If it gets through $7.75 then look for a return to the October highs.

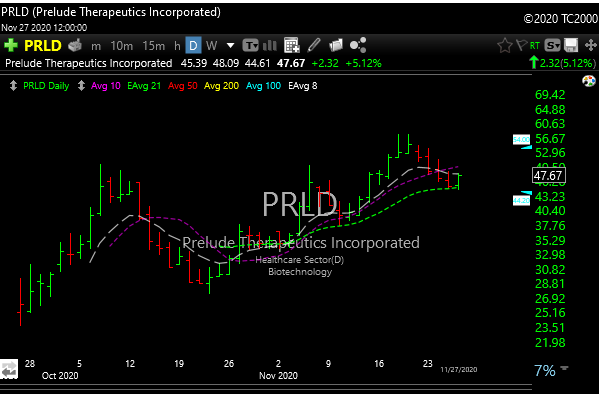

PRLD– This biotech went public a few months ago. I don’t know anything about the science but I am smitten with the chart. It’s thinner and it’s biotech, so position accordingly.

SEED– was highlighted last Sunday, started to wake up Friday. Up almost 10% for the week.

SAIL– technicals turning positive with a nice bullish coil. Could be ready for a run bac to $50 and then higher.

Have a great weekend.

Current P&L here.