Dow: +454.97…

Nasdaq: +156.15… S&P: +57.84..

Value, cyclical, and small-cap stocks retained their leadership roles in this part of the bull market, and the bullish bias carried over to most parts of the market. The S&P 500 energy (+5.2%), financials (+3.5%), and materials (+2.5%) sectors outperformed, while the real estate sector (-0.03%) slipped into the red.

Probably the main reason for today’s bullish action was the appointment of Janet Yellen as the new Treasury under Biden.

We all remember Yellen as our favorite economic lawn gnome. We now have a dovish Fed and a dovish Treasury.

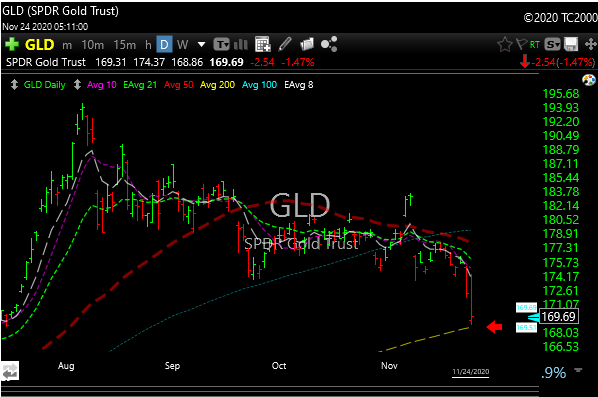

Everybody is busy chasing Bitcoin and the rotation trade. The violent break down has taken gold down to the relatively big 1800 ish level, right on the 200-day moving average.

Ex the March chaos, gold has not closed below the 200 day since late 2018.

I watch the metals all day and I think they are very close to a tradeable bottom. We are long a 1/2 position in AGQ (2X SLV). I may add that other half soon and lower stop as we get a lower cost basis. Let you know.

The P&L has been getting a tad voluminous. so I have being scaling out a little bit here.

P&L here.

I know all of you love uranium so I decided to follow CCJ. I like the base, if I do anything I will let you know.