Dow: -317.46…

Nasdaq: -76.84… S&P: -35.65…

In a year that has been totally upside down from the get-go, we have great news on a vaccine that has a 90% success rate, but along with that, COVID cases and hospitalizations that are running and gunning.

Today, the bad of COVID cases outweighed the good of the vaccine.

The S&P declined 1.0% today, as recovery concerns contributed to losses across all 11 sectors and defensive-positioning in Treasuries. The Dow fell 1.1%, and the Russell 2000 fell 1.6%. The Nasdaq was the relative outperformer with a 0.7% decline.

The day started with slight losses amid profit-taking activity in cyclical sectors like energy (-3.4%), materials (-2.2%), and financials (-1.7%) following news that the U.S. recorded new highs for daily coronavirus cases and hospitalizations. Selling picked up more broadly throughout the day on stimulus hurdles and commentary from Fed Chair Powell.

Europe remains locked down and their 10 year yield is diving.

German 10-year last at “negative” -0.54%.

US 10 year is following slowly, but maybe the lock-down narrative spreads from Europe to the US faster than we think.

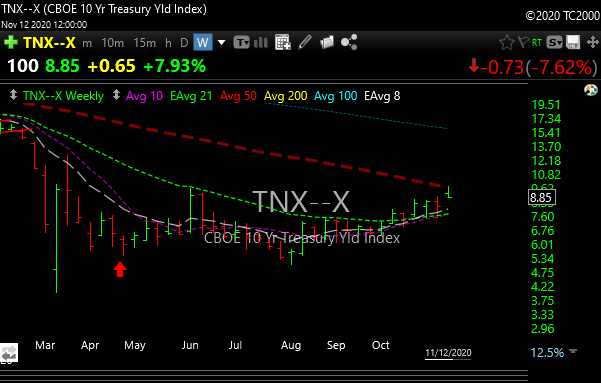

TNX– 10-year yield was rejected at 50 day moving average on weekly chart.

If yield rolls over and the dollar goes weak again, watch the metals.

Gold was green today, silver green but not as much.

Selling climaxes” are usually tested. Monday’s GLD “selling climax” has not been tested, but could in the next few days, before heading higher.

Over the last month and despite the elevated volatility, all equities funds saw inflows of $15bn, the biggest since last April.